There’s nothing resembling a “sharing economy” in an Uber interaction. You pay a corporation to send a driver to you, and it pays that driver a variable weekly wage. Sharing can really only refer to one of three occurrences. It can mean giving something away as a gift, like: “Here, take some of my food.” It can describe allowing someone to temporarily use something you own, as in: “He shared his toy with his friend.” Or, it can refer to people having common access to something they collectively own or manage: “The farmers all had an ownership share in the reservoir and shared access to it.”

None of these involve monetary exchange. We do not use the term “sharing” to refer to an interaction like this: “I’ll give you some food if you pay me.” We call that buying. We don’t use it in this situation either: “I’ll let you temporarily use my toy if you pay me.” We call that renting. And in the third example, while the farmers may have come together initially to purchase a common resource, they don’t pay for subsequent access to it.

In light of this, we should call out Uber for what it is: a company in control of a platform that originally facilitated peer-to-peer renting, not sharing, and that eventually transformed into the de facto boss of an army of self-employed employees. And even as “self-employed employee” might sound like a contradiction, that’s the dark genius of the Uber enterprise. It took the traditional corporation, with its senior managers responsible for controlling workers and machines, and cut it in two — creating a management structure that need not deal with the political demands of workers.

So, how exactly did we get to the point where business executives at conferences can talk about Uber as a “sharing economy” platform with straight faces? How is it that they don’t feel a deep sense of inauthenticity? To understand this, we must return to the roots of the actual sharing economy. It is the only way we can wrest it back from those who have hijacked it.

Our everyday economic life is characterized by three things. First, you get a job at a company — or you start a company — and you produce something. Second, that company goes to market to exchange its product for money. Third, you use that money to get goods or services from others who are also producing. Zoom out, and a market economy is a large-scale network of interdependent production. We cannot survive without accessing the products of other people’s labor.

Monetary exchange takes the form of, “If you give me money, I will give you a service.” There’s always potential for rejection in market offers, which creates uncertainty, and some people fare better than others. Those who undertake the heaviest burden of production don’t necessarily get rewarded commensurately. Individual competition appears to be — at least at first glance — the defining mark of monetary exchange.

There are, however, three major but inconvenient truths that seem to get glossed over when we talk about the market economy. The first is that market systems feed off an extensive, underlying gift economy in which people transfer ideas, goods, services, and emotional support to each other without requesting money. Unpaid childcare is one example. If your mother watches your two children while you’re at a job, that’s the gift economy in action. In fact, without friends and family it’s unlikely that you could even maintain the desire to go to work. Even in professional settings we share common resources with business colleagues. Companies rely upon this internal collaboration to produce the very products they then competitively exchange in markets.

The second inconvenient truth about the market economy is that its products are not really desirable unless we can use them within non-market systems. What’s the point of all this stuff getting produced if we can’t share it, compare it, gloat about it, or enjoy it with others? Friends, family, and various community systems make having material goods meaningful.

And third, many commercial market exchanges are actually hybridized with non-commercial elements that add richness. Take, for example, flirting with a bartender as they serve you drinks, or having a discussion about politics with the stylist you’re paying to cut your hair. Not only do market systems rely on non-market influences in order to work, but their products feel pointless and empty without them. Recognition of this, however, is uneven.

In small community settings it’s often easy to see a balance between market and gift economies. The shop owner gives a spontaneous discount to a retiree, or allows friends to lounge in a coffee shop long after they’ve finished drinking. Commercial exchange is but one element in a broader set of relationships, and this means the exchange takes longer. Economists call this inefficient; we call it enjoying life.

Meanwhile, in megacities such as London or New York there’s a tendency to strip all non-commercial elements from market interactions. This is the hallmark of what we refer to as commercialization. The large-scale mall and corporation are designed to maximize exchange while offering only a shallow appearance of sociability. The McDonald’s employee is forced by contract to smile at you, but prohibited from taking time to have a true conversation.

This phenomenon is even more acute in faceless internet commerce, where clinical, transactional precision dominates. While hyper-efficient exchanges play into our short-term impulses — initially feeling exciting, convenient, and modern — they gradually begin to feel empty. Sure, it’s frictionless commerce, but it’s also textureless.

When detached from a community foundation, markets can bring out people’s most anxious, petty, arrogant, and narcissistic sides, encouraging them to fixate on their individual strands of the overall economic picture, as if it were the whole. The defining qualities of a market economy — like uncertainty and unequal monetary reward — get exalted, and in this frame, everyone else is either a stranger to do battle with or a temporary ally to assist in your personal gain. Socializing becomes “networking.” Non-commercial ties such as friendship, sex, love, and family are either rendered invisible, or presented as kitsch advertisements designed to promote more commercial exchange.

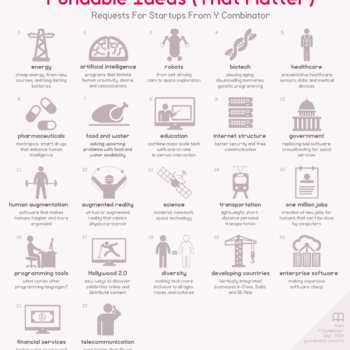

It was in this context that the original sharing economy platforms emerged. Amid the competitive, individualistic rhetoric of the corporate state, people looked to use technology to foreground sharing, gifting, and community activities that were otherwise overshadowed.

One aim was to extend activities between trusted friends to strangers. Friends have long crashed on each other’s couches, but the Couchsurfing site wanted it to happen among strangers. Freecycle allowed you to give gifts to people you didn’t know, while Streetbank let you lend items to strangers in your neighborhood. These platforms encouraged sharing between people who might otherwise be isolated from each other.

All of this was built using the infrastructure of the internet. The ubiquity of interconnected computers and smartphones in the hands of ordinary people allowed them to cheaply advertise their locations and showcase offers. To catalyze a digital platform, all someone needed to do was set up a website as a central hub for aggregating and displaying offers for others to accept. It makes sense to centralize similar information, rather than having it scattered in fragmented locations. This, in turn, builds network effects, meaning that the platform becomes more useful — and thus more valuable — as more people use it.

Attempting to introduce sharing principles into networks of strangers isn’t easy. Our lives are built around large-scale market economies, and many people have internalized the principles of monetary exchange. In the context of huge global supply chains, the rural idyll of community production is long gone, and attempts to reverse-engineer authentic sharing relationships between people we don’t know can feel stilted.

While we might be willing to let a friend borrow our car for the day, we generally don’t trust strangers enough to share our most crucial possessions with them. We may, however, be game to share things that we don’t often use, like a basement that’s only half full or the backseat of a car that could have someone in it while we’re driving to work anyway.

We’ll probably be even more willing to offer this idle capacity to a stranger if there is some third-party assurance that they are legitimate, or will experience some consequences if they behave badly. Likewise, we may be more open to accepting gifts from strangers if such assurances are in place. This is, in effect, why sharing economy platforms developed identity and reputation-scoring systems, adding layers of formality and quantification into non-monetary gifting.

Herein lies one source of corruption, as the very act of earning quantified reputation for gifting adds a feeling of market exchange. But it was building technology to identify and quantify spare capacity that really set the stage for undermining the sharing economy. “Why not get the stranger to pay for the gift as a service?” was a question that couldn’t be far off.

The move from sharing spare, underutilized assets to selling them can be subtle. In hitchhiker culture, a person offering lifts might reasonably expect a fuel money contribution from someone getting a ride — and if the hitchhiker leaves the car without offering it, the driver may be a little irritated. The money though, is never a condition, and until they explicitly say, “If you give me fuel money, I will drive you,” it’s not a commercial relationship. Note, though, how easily the phrase—once uttered—can become generalized into, “If you pay me, I will drive you.”

A new wave of “sharing economy” startups bet on just this concept, as their businesses came to be characterized not by sharing, but by showcasing spare capacity for rent, with the platform taking a cut as broker. So, too, began a hollowing out around the language of sharing. New entrepreneurs feebly hung onto the sharing story with the claim that market mechanisms could re-engineer the very community ties that the markets themselves had eroded. In reality, they were doing nothing more than marketizing things that previously hadn’t been on the market. If anything, this only undermined existing gift economies. A friend calls to ask if she can stay with you, but gets told, “Sorry, we have Airbnb guests this weekend!”

Ah, but there’s another twist. Far from merely facilitating the renting of spare capacity, these platforms grew to such a size that sellers of “normal” capacity started using them—as in, people running professional bed-and-breakfasts migrated to the Airbnb platform, and so on. The irresistible lock-in of network effects dragged the old market into the new, and voilà, the platform corporation emerged.

Let’s be unequivocal here: A platform corporation really only owns two things. It owns algorithms hosted on servers, and it owns network effects—or people’s dependence. While the old corporation had to get financing, invest in physical assets, hire workers to run those assets, and take on risk in the process, a corporation like Uber outsources its risk to independent workers who must self-finance the purchase of their cars, while also absorbing losses from their cars’ depreciation or the failure of their operations. This not only separates corporate managers from ground-level workers, it places the major burden of financing and risk on the workers.

This is a venture capitalist’s wet dream. Give a startup minimal capital to hire developers and run media campaigns, and then watch as the network effects ripple over the infrastructure of the internet. If it works, you’re suddenly in control of a corporation built with digital tools, but extracting value from real-world, physical assets like cars and buildings. The entity holds itself together not via employment contracts, but rather by self-employed workers’ dependence on it to access the market they rely on for their survival.

So, now here you are, staring at your Uber app with irritated sighs because the driver is two minutes late. This is a market transaction. To the driver, you’re just another customer. There is no sharing. You’re as isolated as you ever were.

We have a hard time seeing systems. We find it easier to see what’s tangible and in front of us. We see the app, and we see the driver’s car icon moving along the streets on their way to pick us up. What we can’t see is the deep web of power relations that underpins the system. Instead, we are encouraged to fixate on the flat and friendly interface, the shallow surface layer of immediate experience.

If you’re a driver, that interface doubles as your boss. It doesn’t shout at you like the jerk boss of old corporations. In fact, it shows no emotion at all. It’s the human-readable incarnation of a robotic algorithm that calculates the optimal profit-path for Uber, Inc. As a driver, you have no colleagues and no union. There’s no upward mobility. Uber wants you to leave as soon as you build any expectations of progress. You and thousands more eke out enough to survive, if you’re lucky. This all while the owners of the platform get richer and richer, no matter what.

Of course, if you want to put a positive spin on this kind of work, you can call it flexible, decentralized micro-entrepreneurship. But pan out, and it looks more like feudalism, with thousands of small subsistence farmers paying tribute to a baron that grants them access to land they don’t own.

So, what is to be done? For one, let’s first understand the problem. Innovation and change are pointless unless they’re coming from a real analysis of what’s gone wrong—especially when we’re being made to believe we’ve actually gained an asset. Only then can we rebalance the power.

If we are going to turn ourselves into a sprawling network of micro-entrepreneurs, micro-contracting via a feudalistic platform, let’s at least cooperatively own the platform. In doing this, we might even retain one definition of sharing — the common usage of a shared resource pool, like the farmers who collectively manage a reservoir.

This is the origin of the platform cooperativism movement, one possible counterforce to the rise of platform capitalism. In principle, it’s not that complicated. Spread the ownership of the common infrastructure among the users of that infrastructure, give them a say in how it’s run and a cut of the profits that emerge from it.

The platform cooperativism movement is a new one, with many of its proposals still on paper and yet to be released into the wild. Many have seen the potential to use blockchain technology, whose original promise was to provide a means for strangers to collectively run a platform that keeps track of their situation relative to each other without relying upon a central party. Some, like the blockchain-based ride-sharing platform La’Zooz, have already released apps and are iterating away in the background. Others, like the blockchain-based proposal for an Uber-killer called Commune, are still in their conceptual stages. Arcade City, another attempt at an Uber alternative, has been dogged with controversy—and a split in the team has led to the creation of Swarm City.

Meanwhile, big corporates have increasingly encroached on blockchain technology with an eye toward using a pacified version of it within closed and controlled settings. There are, of course, plenty of talented and idealistic blockchain developers looking for opportunities beyond corporate life.

Either way, fancy technology isn’t a magical recipe. The equally important work involves building a community willing to back new platforms. A Dutch proposal for an Airbnb alternative called FairBnB is making a start as a Meetup group, and food couriers are organizing gatherings to discuss how they can set up cooperative alternatives to Deliveroo.

In the face of massive commercial platforms, aggressively backed by venture capital money, these initial attempts might seem idealistic. But as digital serfdom only expands, we have little choice but to start small with underdog pilot projects that galvanize action.

It’s a new mentality that needs building. In a world where we’re told to be grateful receivers of products and the opportunity to work on them from heroic, demigod CEOs allegedly “democratizing” the workscape, we need to see straighter and expect more. The entrepreneur is still nothing without the underlying people who make their enterprise work; and in this case, their wealth comes directly from skimming money off vast collectives. Let’s fuse the two forces into one, and build collectives with actual sharing in mind.

______________________________________________________

About the Author

This article was written by Brett Scott, author of The Heretic’s Guide to Global Finance: Hacking the Future of Money. Exploring urban ecology, economic anthropology, P2P tech & alternative currency.