Impact investors have a critical opportunity to help their portfolio companies navigate the coronavirus pandemic. Here are three concrete steps you can take to support and safeguard the impact of your portfolio companies now and in the future.

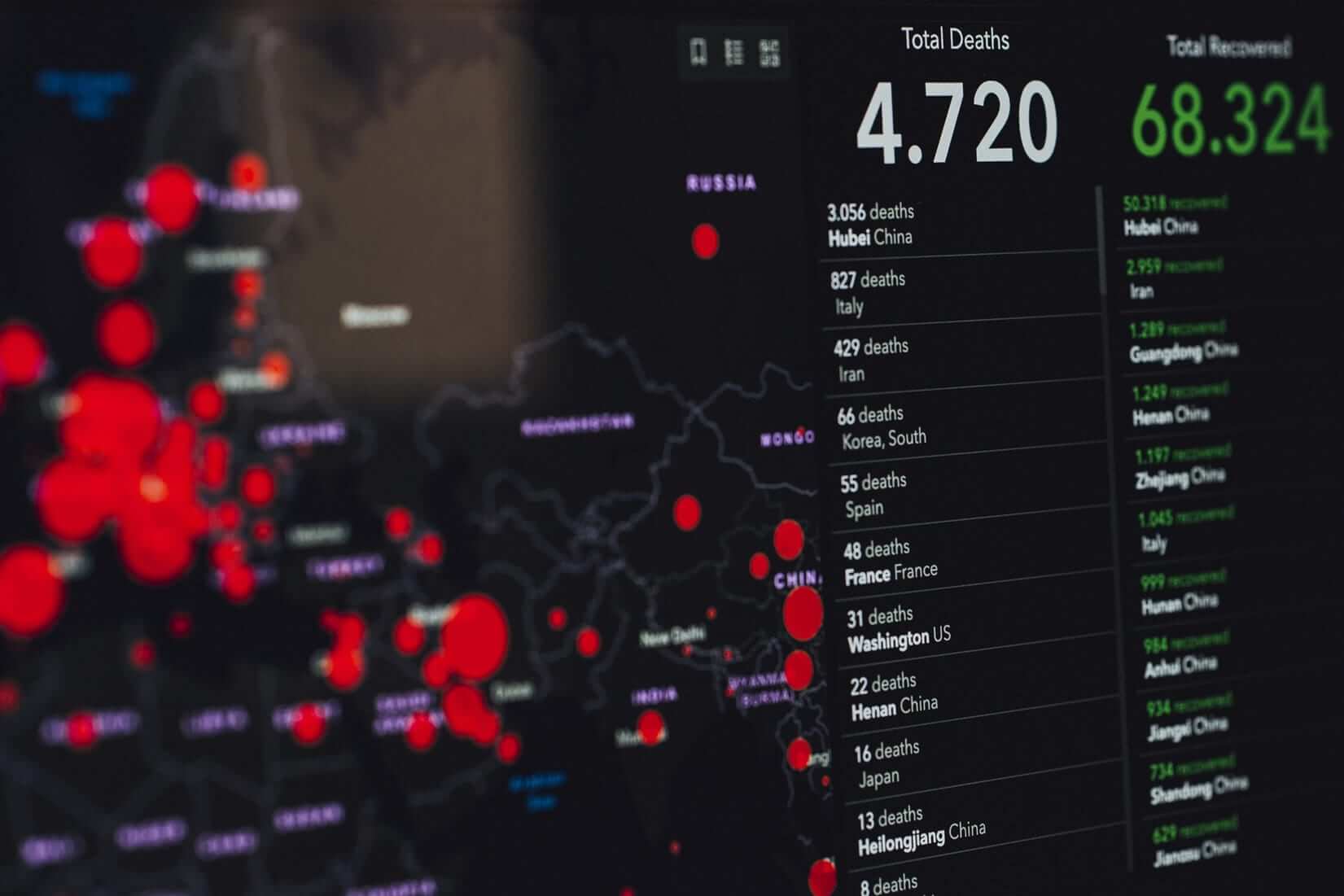

The unfolding human and economic toll from COVID-19 poses an enormous challenge to all businesses, large and small. A recent Dun & Bradstreet report found 94 percent of Fortune 1,000 companies are experiencing supply chain delays. Around the world, small businesses struggle to stay afloat as governments force closures of all but the most essential. Impact investors confront similar hardships. They and their portfolio companies are facing tough decisions about short-term responses and longer-term effects.For more COVID-19 resources, see our Nonprofits, Funders, and the Coronavirus (COVID-19) Crisis special collection.

The emerging impact investing field has made important progress over the past several years in its quest to marry market-based investing with social and environmental impact. The coronavirus pandemic calls for urgent attention to sustaining (and even accelerating) that progress by supporting the impact goals of portfolio companies. This is especially relevant for private equity, which can take a longer time horizon on many investments. It’s not only the right thing to do from an impact perspective, but also financially. Recent Morningstar data showed that in a down market, the year-to-date returns of nearly three-quarters of sustainable equity funds ranked in the top half of their category—and nearly half ranked in their category’s top quartile.

Here are three things we believe impact investors can do now to safeguard the impact of their portfolios and provide much-needed leadership in the investment community.

Provide portfolio companies with frequent, honest communication

While communication with limited partners is a pressing need, it’s ultimately your portfolio companies that will deliver—or struggle with—financial and impact objectives. Make communication with portfolio companies a top priority. Good Finance, a UK-based collaborative of social investors, reassured their investees that they will be “as flexible as possible” during this time: “If you have an investment from one of us and think you may need support or flexibility, please get in touch, we will do our best to help. If you might need investment to help you through difficult trading, please speak to us.”

Providing reassurance that you are focused on the end goal can take pressure off meeting short-term targets. Open Road Alliance, a philanthropic impact investor specializing in loans, put it this way in ImpactAlpha: “Our approach is one of service—we are here to serve, to do our best to ‘stay on the same side of the table’ with borrowers. And right now they need your help.”

While open communication is key, don’t overpromise. One of the hallmarks of effective crisis communication is regularity and honesty. “Transparency is ‘job one’ for leaders in a crisis,” advises Harvard Business School Professor Amy Edmondson. “Be clear what you know, what you don’t know, and what you’re doing to learn more. You can’t manage a secret, as the old saying goes.”

Focus on people first—especially the most vulnerable

Priority one in the first weeks of this health crisis is everyone’s safety and wellbeing. Make sure all of your portfolio companies are taking effective health and safety measures for their leadership, staff, and customers and clients. Important questions such as “do your employees have paid sick leave” and “what is your commitment to hourly workers” are the initial steps towards doing so.

Two resources that can help:

- The International Labor Organization (ILO) recommends concrete steps to protect employees in the workplace to minimize the direct effects of the coronavirus, including encouraging flexible working arrangements, expanded access to critical benefits like paid sick-leave, and preventing discrimination and exclusion.

- HCAP Partner’s Gainful Jobs Approach lays out an impact framework for assessing existing job quality and strengthening quality jobs within portfolio companies.

Once you have covered those table-stakes questions, it’s time to turn to the more complex questions like “how can we avoid mass layoffs?” and “in what ways can we be flexible with our capital to help our portfolio companies put people first?”

The pandemic is also elevating equity concerns along a number of lines, including racial and ethnic, socioeconomic, and gender. Softening the impact of the crisis on the most vulnerable people and communities should be everyone’s responsibility. While conversations around diversity, equity, and inclusion are still in early days in the mainstream investment world, impact investors have started to more intentionally bring a diversity lens to investing. Building off this momentum, now is a critical moment to ask questions like “what disproportionate effects will this have on historically marginalized workers and their families?” If left unexamined, there is a very real risk that changes in portfolio company policies and practices may reinforce or exacerbate structural inequities in profound ways.

Double down on impact-management advice and support

Pivoting into crisis response mode and making the right calls to survive, and ultimately thrive, will put portfolio companies to the test. Now is the time for investors to step up with management advice and hands-on tactics to help portfolio companies through the crisis.

Look for new ways to help your companies double down on impact. Just as you are supporting them in reforecasting financial performance, they also will need your support in reexamining their social and environmental impact goals and accompanying key performance indicators.

There may be new impact pathways not previously anticipated. For example, in the near term this could mean reaching new, now high-need customers (e.g., online education) or repurposing a supply chain (e.g., for personal protective equipment). Looking to the longer term, it could be about investing in capabilities key for recovery (e.g., supplier diversification) or responding to permanent changes in both consumer and business behavior (e.g., virtual services).

While it may be tempting to pull back from some or all of your portfolio companies to minimize economic hardship and protect your investors, use this pandemic crisis to help them have even greater impact. Ultimately, you want your portfolio companies not just to survive, but to see and seize new opportunities and to innovate in ways that position them for both viability and impact in the long term.

We are already seeing a number of businesses commit to critical steps to protect their people. More than 1,500 CEOs around the country signed a pledge to #stopthespread and #leadboldly, led by Kenneth Chenault at General Catalyst and Rachel Romer Calson of Guild Education. “Wherever we can, however we can, we must meet this unprecedented challenge as generations of business leaders have before us,” they wrote in a New York Times op-ed. Impact investors could spearhead something similar, offering much-needed leadership in the investing community. A time of crisis is also a time to step up. We are all in this together. In fact, we are all impact investors now.

About the Author

This submitted article was produced by Bridgespan, a global nonprofit organization that collaborates with mission-driven leaders, organizations, philanthropists, and investors to break cycles of poverty and dramatically improve the quality of life for those in need. See more.