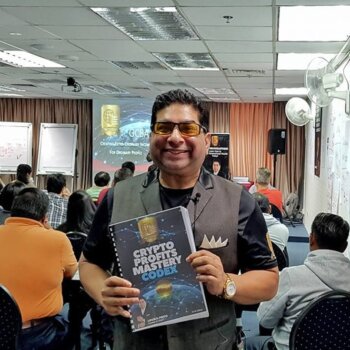

Ajay Jaiswal has 24 years experience in Financial Services. The last 18 years he has worked in leading positions as Head of Research, Investment Strategist and Portfolio Manager.

What’s your story?

My story in stock market started when after I graduated in Commerce and took up my first full-time job in January 1994 in an esteemed Equity Research outfit catering its services to Foreign Institutional Investors, Mutual Funds, and Financial Institutions. I loved tracking global developments since childhood and especially price trends in commodities, currencies, equities and social changes. When I stepped into working shoes I believed data is God for stock markets and hence researched on data price trends across industries, especially commodities. When the Asian Currency crisis took a toll on Indian markets I was surprised that most senior analysts were unable to time the crisis as most did traditional research of Analyzing Annual Reports and Prospectuses (Corporate offer documents) and relying on kbhbars (a term widely used in the early ’90s of insider activity of companies). That was when I got a kind of enlightenment that I must keep myself abreast with the latest developments and hence I got the professional tools( Bloomberg, Reuters) installed and closely watched and generated investment/trading leads across equity, commodity currencies.

I work with Stewart & Mackertich as President: Research and Strategies and live in Kolkata, West Bengal.

What is your involvement with Investment?

I generate leads for my Research team and head the Research Division of Stewart & Mackertich. I am also one of the three members of the Core Committee for Portfolio Management Services in our Company, Stewart & Mackertich. I also formulate strategies for growth of the organization in the financial services business. Over the years, I have generated many investment leads, most popular being Brand Value Picks in my previous company, where a selection of bright small and small cap companies were identified on the consumer growth theme in India.

How did that come about?

In my career of 24 years, last 18 years I have worked in leading position in Financial Services Industry as Head of Research, Investment Strategist and Portfolio Manager. The investment leads and ideas generated by me are usually a non-traditional approach and more to do with thinking out of the box. In a nutshell, I try to identify the early trends in companies, sectors or anything to do with fundamental changes in society. This has led me to find several multi-bagger investment ideas ahead of the time. The current company was looking to hire someone of my type and I got an opportunity to work here as President –Strategies and Research at Stewart & Mackertich.

What are some of the key things you have learnt about Investing?

The most important lesson I have learnt in investing is never trust a management if the management has in any way flouted investor’s interest or has been non-compliant. This has been the most important learning and I have always practised this. Some of the groups or managements whom I have avoided since I began my career have badly under-performed over the years. In some circles, I am better known as someone who has advised investors to avoid certain stocks or ideas and they have miserably underperformed over the years. Companies of management who have flouted such norms have underperformed over the longer term or may have been booked for non-compliance which has eroded shareholder wealth.

What mistakes do you see less experienced investors making?

Less experienced investors generally go the market buzz and hence they buy when there is irrational exuberance or euphoria and sell when there is unwarranted pessimism. They simply forget the basics of investing which is to buy when valuations dip and sell when valuations ripe. Less experienced investors also fall prey to hearsay in the market and seldom verify factors before investing. Less experienced investors also tend to buy lower priced stocks on the hope of its being cheap but do not verify whether it holds fundamental value, which is generally not true.

What mistakes do you see Entrepreneurs making?

Stock Market gyrations sometimes drive entrepreneurs to act against the core fundamentals of the market and get driven by sentiments. Such entrepreneurs and businesses seldom see long-term growth and succumb to short-term policies. In my 24 years of career in the financial services industry, I have witnessed many entrepreneurs who haven’t been able to build sustainable businesses. The other mistake is they are unable to build a professional structure in the organization which eventually limits growth or leads to the debacle of their businesses.

What’s the best piece of advice you ever received?

The best piece of advice I ever received was from my childhood buddy who inspired me to join the research division in an Equity Broking outfit despite me having less interest in financial aspects and more inclined towards social psychology and behavior analysis. Since he was a close friend and knew my interests, he thought was best fit to identify early leads. Not having a professional degree then it was always a limiting factor for career progression according to me but his confidence imbibed in me led to strive at every step which led to my career progression.

What advice would you give to those seeking funding?

Those seeking funding should always show their track record of timely payment of instalments and fulfilment of commitment. This one factor leads to easy availability of funds and sustainable growth. If unable to keep commitment, it should clearly be communicated to vested parties citing the reasons.

Who inspires you?

Individual or companies that keep their focus on the core business inspires me. There have been several instances where companies or individuals change the track of their businesses or focus more on their personal agenda than equity shareholders. If homework is properly done, in most cases one can separate the wheat from the chaff. Also, I believe equity is a cult and I admire some entrepreneurs as they develop this cult since the inception of business and set an example. I am inspired by Mr. Narayana Murty , Mr. Ratan Tata, Piyush Pandey and the Pidilite Industries, Asian Paints and Shree cement Group among others.

What have you just learnt recently that blew you away?

I learnt about financial technologies which have led to business growth and leadership of some leading NBFC companies in India which blew me away. Despite being among the firsts to have identified as an investment idea in the company, never did I imagine the company would evolve into an NBFC giant and rule in terms of market share and profitability as the company adopted Fintech as the basics of growth.

What business book do you recommend the most?

Emotional Intelligence by Daniel Goleman, The Intelligent Investor and One Upon Wall Street. Generally, I don’t recommend business books as most of them speak about the traditional approach to investing or academic lessons on investing. Although I value and respect opinions and views of most of the business book writers, I always look for that non-financial material in entrepreneurs or the key managerial personnel in the companies. Hence, ethics, compliance, disclosures speak volumes. However, one non-finance book I always recommend to all budding researchers is written by our Former President Abdul Kalam Azad’s“Ignited Minds”. It is a must read.

Shameless plug for your business/organisation:

Nothing as such except that despite a leading company in the financial services industry and despite being an incubator to many leading names in the financial services sector in India, we were not able to build an impact and grow business over the years in a corporate structure due to lack of professionalism, corporate structure and compliance.

How can people connect with you?

People can connect me through LinkedIn or through my email ID [email protected]

Social Media profiles?

Facebook: https://www.facebook.com/ajayjas

LInkedIn: https://www.linkedin.com/in/ajay-jaiswal-7410b724/

Twitter: @ajais_bloom

—

This article is part of the World Business Angel Forum media partnership with AsianEntrepreneur.org

If you would like more information about WBAF, please contact Callum Laing WBAF High Commissioner for Singapore. [email protected]