In pursuit of the good life over the course of our lives all of us expect our standard of living to materially improve. Can we expect this to continue or will we need to give new meaning to ‘the good life’ and tell ourselves a different story?

To raise living standards a growing economy is considered a given, conventionally indicated by 2% annual rise in GDP. While there is nothing particularly new in saying rising GDP is a superficial evaluation of a prosperous economy, well-being or the good life, which Tim Jackson details in the recently revised edition of “Prosperity without Growth”, what is illuminating is how the economics of pursuing GDP growth leads to the economy coming undone, by pursuing GDP growth!

Sounds implausible you might think, while reaching for a copy of Angus Deaton or Deirdre McCloskey, lets not kill the goose that lays the golden egg, there’s nothing wrong with the foundations, things just need tweaking. The growth of the consumer economy since WW2 has delivered far reaching prosperity through rising incomes, this is true and also the equivalent of looking through the rear view mirror while driving the car forwards, as we shall see.

And look who’s in the driving seat. Why else would Xi Jinping say the word “growth” thirty-eight times addressing the Davos faithful this year, along with his commitment to the “hard-won” Paris Agreement capping carbon emissions to 2C. Why else would Paul Polman, CEO of Unilever and leading light of the circular economy, recently call the low-carbon economy “the greatest opportunity for growth the world has ever known”. Why else would the New York Times judge “the central task of our time is how to respond to slow growth and social disaffection” then ask “who has the compelling plan to boost economic growth?”

What they fail to say is how they are attempting to fit a economic square peg into an ecological round hole.

Taking the planetary boundaries established by the Stockholm Resilience Centre and assuming we get the flat-lining economy back on track growing at 2% here and around 7% in the developing world while also meeting the Paris Agreement commitments, we would have to reduce the carbon intensity of the economy by a monumental factor of 200 times for every $1 of output, in an economy that by 2100 will be 20 times bigger than today.

There is no evidence this can be achieved. But best left unsaid if you want to remain in power or retain influence within the corporate and political sphere.

You might not agree and default to the luke-warmer business as usual position. Embark on an economic stimulus plan, forget Paris, ignore an MIT study that concludes within fifteen years we’ll no longer be able to take natural resource fuelled growth for granted, and by 2070 Bangladesh, for example, will be as rich as Holland is today and will be able to afford its own flood defenses, if needed.

Or, you could take the position of numerous social impact investor funds building “21st century purpose-driven brands seeking to maximize financial and social impact”, who believe that just as “Wall Street helped finance our transition from agriculture to a services-based economy. It will now finance the global shift towards a sustainable shared economy”.

Or, you might find either of those positions illusory and believe we need to take the bull by the horns. If we don’t grow the economy we risk social collapse, if we do grow the economy we risk ecological collapse. As Jackson writes, “we live in a system reliant on growth for stability which has become unstable because it cannot reliably deliver growth”, otherwise known as the mess we are in.

This dilemma has to be confronted. Health, education, and meaningful work matters, equally, and much less acknowledged or understood is material things matter too. The goods and services we use everyday are as much a means to communicate with each other as for the functional use they provide.

To be clear, the consumer economy matters, we use it to create our identities, a sense of belonging, and as Mary Douglas once put it “find a creditable place for ourselves in the world”. To sanctimoniously disparage it as some corporate capitalist narcotic keeping ‘the masses’ somnambulant, as some on the left love to do, is about as useful a contribution to the discussion as the luke-warmers is to global warming. We are going to need to unpack how it works and decide what to keep and what to junk.

How then to design a stable consumer economy that delivers the amenities of a modern economy within ecological boundaries?

One part of the answer is to redefine what we mean by growth, to include the good stuff that cannot be quantitatively measured, like your kid reading a book from the library, or time spent nurturing our relationships.

Another perspective could be to redirect the creative talent of the advertising industry and ask, rather than stoking desires and insecurity how would its copywriters remove fear and anxiety instead?

All well and good but as Jackson says, “we have to get the economics right”, our consumer society is a function of the economic system. Is it serving us or are we serving it? We need to get under the skin of it and from here design the kind of society we want to live in because everything else flows from this.

The conventional “Wall Street” growth model is straightforward. Money is issued by private banks as debt plus interest, the only way to pay back rising debt is a growing economy. Money goes in search of enterprise that can deliver rising returns, through efficiency and innovation. Make stuff and deliver services more efficiently, with less labor time, profits will rise and the stock market goes up. While also resulting in an unfortunate side-effect of rising unemployment, and subsequent falling incomes, falling consumption, a shrinking economy causing more unemployment and a spiral into recession. Oh.

Unless, that is, demand outstrips productivity through the essential restlessness of consumerism. Anxiety inducing, pathological and wasteful it maybe, as well as revenue generating, tax paying and the source of comparative economic stability. We can’t live with it or without it, so it seems.

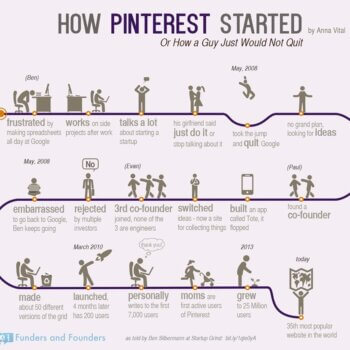

Innovation, creative destruction, disruption, the unrelenting pursuit of new stuff to ‘satisfy unmet needs’ as the marketing textbooks have it, to fire our unfulfillable desires or manipulate our emotions, depending on your point of view. Entrepreneurs driving the consumer economy forward, creating new and better goods and services, creating new jobs, rising incomes, people buying stuff, and paying down the mortgage debt that created the money in the first place to create the jobs. And that’s true too, in the sense that entreprenurial new business formation is the single biggest guide to future employment and net new job growth comes from firms in the first five years of their existence.

And yet, as Nicholas Eberstadt, of the American Enterprise Institute, recently wrote, “for reasons that are unclear…21st century America has somehow managed to produce markedly more wealth for its wealth-holders even as it has provided markedly less work for its workers” and “we are witnessing an ominous and growing divergence between three trends that should ordinarily move in tandem; wealth, output, and employment”.

So something has gone wrong with the Wall Street growth model. Although a leftist would point out actually it’s working exactly as it should, wealth is being created collectively and then appropriated privately!

One reason that is clear, is we pursued synthetic growth through vulture capitalism. Financialization, shadow banking, housing and asset bubbles, speculative share buyback schemes, subsequent low investment, and for all this major banks are still insolvent. So you might conclude this particular version of capitalism is a busted model on life support which is also at some point going to hit the ecological buffers.

Jackson’s answer is, “a clear conceptual foundation for a new economics”, broadly organized into three areas; the nature of enterprise, the quality of work, the role of money and investment.

For example, if we strip the right of private banks to create the money supply, a move so controversial even Martin Wolf of the Financial Times has proposed it, our investment strategy could be re-directed to creating jobs that resist the efficiency trap embedded in our current system. That means skilled work making high quality, resource light goods and services.

Some of the firms James Fallows recently wrote about in “Can America Put Itself Back Together Again” would fit, or take a look at the revolutionary work of agronomist Leontino Balbo, who supplies a third of the worlds organic sugar. It also means radically changing the nature of ownership, for example, creating an equivalent of the Austin Taxi Drivers Cooperative, in Texas, in every American city and putting Uber out of business.

If one side of the coin is production, the other side is consumer demand.

Jackson writes we have to confront “the social logic” of “materialistic novelty seeking individualism that keeps the economy afloat”. One possibly glib response would be to design and create non-materialistic, post-ownership novelty seeking that’s social and collectively shared. Though making a serious point that secular stagnation isn’t going to convince anyone, and it goes back to the question posed at the beginning of the piece.

Perhaps flipping Foucault’s idea of ‘governmentality’ on its head, in the sense of attempting to produce behavior best suited to fulfill socially desirable policies, is one way to think about it. How we then signal social status will evolve out of these new behaviors. There is an as yet unexplored strategic role for behavioral economics, marketing and advertising communications in this which is unfortunately now getting the brush off in environmental circles, for reasons that appear to be a discomfort with any form of communication that is not mobilization through rational persuasion, whether that’s facts or ‘values’, coupled with a dismissal of paternalistic nudging, rather than seeing it as one element in a bigger creative strategy.

Meanwhile Jackson moves on, “dismantling the complex incentive structures requires systematic attention to the myriad ways in which they were constructed”, and, “simplistic exhortations to resist consumerism are bound to fail”.

Agreed, and much like Dichter, Martineau et al constructed, in their telling, a post-war consumerism to psychologically defeat communism and liberate America from guilt, frugality and ‘repression’, by which I suspect they meant agrarian Protestantism – while recognizing with hindsight that also resulted in women in bungalows with washing machines baking with ready-made cake mix – you could go onto to say we have to figure out how we find a way to construct a new social logic, a “language for goods” that also performs the role so well articulated by Mary Douglas back in the ‘70’s. This is a messy and imprecise business, it too must be confronted.

“Making the nation cry…and buy” is the title of a case study for the chain of employee-owned department stores The John Lewis Partnership, the most successful, highly awarded and culturally resonant advertising campaign in the UK in recent years. Their Christmas time commercial strategy of “thoughtful gifting” delivered $300m of incremental profit within three years, and business-wise is still very much the gift that keeps on giving.

John Lewis’s annual report goes into detail on their sustainability, animal welfare, human rights and local sourcing practices, they score highly on comparative audits. Their stated purpose is, “the happiness of all its members through their worthwhile and satisfying employment in a successful business”. Their commercials are some of the most powerful emotional stories told in the UK, arguably bringing to life the idea of “mindful consumption” in the biggest shopping period of the year. Astonishingly, the top five coops in the UK, of which John Lewis is one, pay more tax combined than the combined UK contribution of Apple, Google, Facebook, eBay and Starbucks.

Is John Lewis bringing intrinsic values to life in the economy, or is it perniciously manipulating emotions and advertising to kids? Does John Lewis meet some criteria of a post-growth capitalist enterprise, if so what and by how much? Or is the ‘fairtrade Amazon’ employee retail coop Fairmondo the future?

What about here in the U.S. where consumer coop R.E.I. just posted record revenues, and we have seen the rise of the Toms buy-one-give-one-back model, B-corps, ‘conscious capitalism’ and ethical consumption.

It might sound curmudgeonly to criticize the good intentions, but, the competing certification programs are leading to an audit war where more effort is going into certification and the ‘badge’. Same with social entrepreneurship becoming a mutant form of conspicuous consumption, rather than actively questioning the economic paradigm and investing in those values directly, capital spots an opportunity and co-opts the language but not the substance.

Ultimately economics is about people and what we do with each other, the constituency for establishing a new arrangement between ourselves will simply come about as more people have reason to believe they will be better off that way. To answer the question posed in the title, the changes in productivity, work and enterprise will knock on to demand, the purpose of advertising and the stories we tell will evolve from the shifts in culture and could be accelerated by progressive advertising.

A sense of disintegration is pervasive. As more and more people rethink ideas of privilege, status, sexism, what we have silently agreed aspiration to be, adoration of wealth, meaningful work and everything that adds up to the good life, Tim Jackson’s book is an important intellectual anchor, a guide, a text to return to and sense check reality and events as they unfold.

About the Author

This article was written by Rupert Newton, writer and independent strategist.