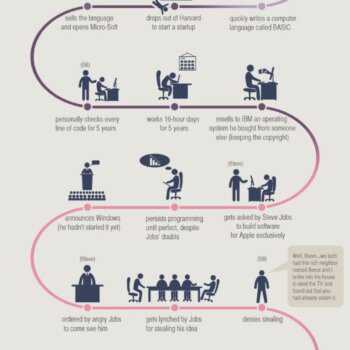

Okay, let’s get serious and talk private equity. The process of realising and growing a business venture inevitably raises the important question of how to finance it. This consideration is a particularly significant one for many growing ventures, as their founders tend to possess only a finite amount of personal funds that may not fully extend to cover the entire growth process of their ventures from the point of inception to maturity.

External funding is generally required, the lack of which can effectively limit the growth of the business. Traditionally, such funding has predominantly been sought through 2 major means: i) debt financing and ii) equity financing. The former is typified by the assumption of debt, specifically the acquisition of financial funds with an obligation of repayment. This exercise has commonly taken the form of seeking loans from banks or other financial institutions, as well as the usage of other forms of credit such as leasing and credit cards. The latter is typified by the apportioning of equity, specifically the acquisition of financial funds in exchange of a portion of business ownership.

Conventionally, such funds have been sourced through investments from venture capital firms, as well as private and institutional investors alike.

Nevertheless, securing external funding from these sources have proven to be quite difficult for growing ventures. The difficulties arise from the distinct nature and characteristics of growing ventures. Compared to more established businesses, these ventures generally lack track record for commercial performance, lack collateral and are not strictly subject to intricate disclosure regulations in most jurisdictions. Consequently, asymmetric information and agency issues come to characterize them. From this perspective, it is difficult for external funders to objectively and consistently gather deep insights into the nature of the risks involved and furthermore, assess the potential value of the venture itself. This renders risk mitigation and managing returns on investments for external funders intractable.

These issues are further exacerbated by the fact that, conventional debt and equity financiers such as banks and venture capital funds generally operate as pooled investment funds with the need to adhere to strict due diligence and the objective to meet healthy returns on investments. As a result, very few debt and equity financiers are willing to fund young ventures. For venture capital firms, the focus has been on businesses that are already in phases of strong performance and proven growth, nonetheless; the rejection rate for funding is held as high at 80% with only 1.4% to 3.4% of investment proposals successfully receiving their requested funds. Likewise, a recent research study conducted in the U.K. last year, has demonstrated that only less than 19% of young ventures secured a business loan from commercial banks; whilst in the U.S. up to 79% of young ventures has had to depend on personal savings when it resorted to accessing startup loans.

These circumstances have led to the materialization of a “funding gap” that exists for ventures that are still in the initial stages of development and growth, whereby with few external funding options accessible, it is widely expected that these ventures will resort to their own resourcefulness in procuring these early funds mainly from internal sources such as family and friends (FFFs); with more external options becoming available as the ventures grow in revenues and performance.

According to a recent report, the gap has recently been widened even further with the recent financial crisis which has resulted in more risk-averse funders, particularly in debt-financing, considerably straining sources of early-stage growth capital. Within this context, it is certainly understandable why the first successful external funding is often considered a very significant milestone for a growing venture.

In spite of this, the funding landscape has seen phenomenal developments through the years. Specifically, crowdfunding, business acceleration and angel investments have emerged as comparatively new ways to fund growing ventures.

Interested in learning more? In a series of articles, I analyse and write about how these new financing sources are attempting to address the funding gap identified above, but more importantly, how they can serve as more effective ways of funding growing ventures. see more.