The eye-popping sale price of US$69 million on March 11, 2021, for a non-fungible token created by the digital artist Beeple sent shock waves through the art world. More multimillion-dollar sales of these digital assets that exist on a blockchain and are maintained on networked computers soon followed.

At the same time, art museums have faced substantial financial shortfalls accelerated by a decline in visitors and donationsinduced by the COVID-19 pandemic. Many have considered taking drastic measures, such as selling treasured artworks, to plug budget gaps.

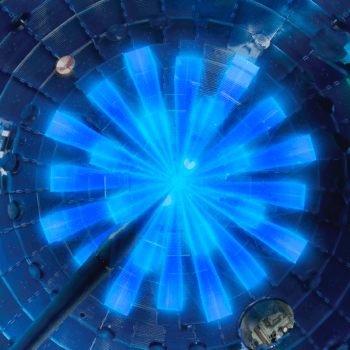

Can NFTs generate the revenue many museums sorely need? Some are issuing their own tokens, including the British Museumand the Academy Museum of Motion Pictures. The Miami Institute of Contemporary Art accepted an early NFT from a donor. There’s even an NFT of entire museum called the Museum of Digital Life.

Yet, more than six months into this disruption of the art world, museums have generally engaged very little with NFTs. As researchers who examine both the finances of nonprofit organizations and the growth in NFTs, crypto-assets and other associated blockchain applications, we see four primary reasons why museums have failed to turn the NFT craze into a financial windfall.

1. NFTs are complicated

The people running museums have expertise encompassing art, education and curation. NFTs are an entirely different realm that’s quite detached from art and have more in common with crypto-currency than typical artworks like paintings and sculptures.

What sets NTFs apart from crypto-currencies like bitcoin and ethereum, which are designed to be interchangeable, is that each NFT represents a unique asset. Figuring out how NFTs must be treated, held and valued is hard, and the ability to quickly mint NFTs for auction is not something that may come naturally to museum staff. What’s more, NFTs are typically bought and sold with crypto-currencies, and not many organizations – including museums – regularly make transactions using them.

On top of any missing financial know-how and a culture that seeks to minimize risks, there are legal complexities and insurance complications. So we can understand why museums have not rushed into the NFT market.

2. The monetary upside might be missing

The connection between the ownership of a piece of art and an NFT associated with that artwork can be confusing. Although it may appear otherwise, the NFT is a separate asset from the art itself. The owners of the art retain ownership even after any NFTs derived from that art are minted and sold.

This separation may mean that the owner of the art has no particular ability to turn an affiliated NFT into a big payoff. Much like the value of a painting has little to do with what the paint, canvas and frame are worth, an NFT’s financial value is subjective. It depends on what others are willing to pay.

The creators of the underlying art, such as musicians and artists who retain control over their work, can – and do – mint NFTs connected to them. Once art is held in a museum collection, however, the value of NFTs is less clear.

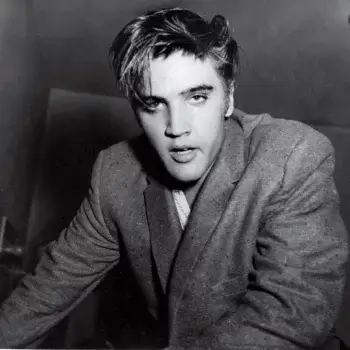

Much like an author-autographed copy of a book can be more valuable than a book without that signature, an NFT minted by an artist of a popular artwork can attract interest from collectors. On the other hand, a book signed by the publisher or an NFT minted by a museum is bound to be less appealing to collectors. An artist-minted NFT that a museum holds could fetch more interest.

Stated another way, even if a museum possesses valuable artwork, that does not mean minting NFTs is a guaranteed revenue stream.

3. The NFT market values artists, not institutions

One underlying reason the market for NFTs tied to artwork has thrived is because buyers view purchasing and holding an NFT as a means to interact with and financially support the artist.

More broadly, the ethos is one of decentralization, and NFT buyers are less likely to be enthusiastic about an intermediary joining the fray.

An example of the ethos built around supporting artists is the prevalence of smart contracts that secure royalties for the artist that will flow every time an NFT tied to one of their works is sold.

In fact, the monetization often touted as the primary upside for museums seeking to jump into the NFT market may not be as simple as initially appears.

First, museums need to see whether monetizing their existing collections would in any way undermine public access to collections – potentially violating their missions and bylaws. Second, they must have protocols in place to ensure that proceeds from sales tied to the collection are correctly reinvested. And there’s a risk that this process could inadvertently lead to pieces of the collection being treated as financial instruments if income is being generated from them rather than solely serving as items on display for the public.

Moving forward, it remains to be seen whether NFTs will financially benefit brick-and-mortar museums, rather than creating new opportunities for virtual ones.

4. Volatility and uncertainty make NFTs risky

Though the high prices they can fetch are eye-catching, there are countless cases of NFTs that quickly become worthless.

And, as with crypto-currencies, there’s lots of volatility. The value of several NFTs have undergone massive and dramatic losses, including ones issued by Grimes, A$AP Rocky and John Cena.

Relying on NFTs to raise cash may be risky, and the boards of museums may determine that it’s inappropriate for their charitable organization to own them. That means museums may be forced to quickly liquidate any NFT they mint or receive – even if that sale will make the NFT less valuable to the institution.

Also, there is still a great deal of uncertainty about what valuable NFTs can do for an art museum’s primary goals. They are neither physical in nature nor works of art. Even digital artwork that can be displayed is separate from any NFT derived from it.

To be sure, NFTs are still new. Banks and other traditional financial institutions initially stood on the crypto-currency sidelines but have slowly assumed a bigger role in those markets. It is certainly possibly that something similar will occur with traditional institutions in the art world as the NFT market matures.

About the Author

- Brian Mittendorf Fisher, Designated Professor of Accounting, The Ohio State University

- Sean Stein Smith, Assistant Professor of Economics and Business, Lehman College, CUNY