China continues with its plan for the launch of its official cryptocurrency, paying particular attention to one of the least-talked about, but enormously important aspects of previous experiences with virtual money: how to distribute the stuff.

This has been the fundamental problem: aside from a comparative minority of well-informed and wealthy individuals, most of us have little understanding of how cryptocurrencies work, which is why only a relative few have been able to accumulate them in sufficient quantities to make real money when they become popular. To put this in perspective: around 1,000 people, the so-called bitcoin whales, own around 40% of the total bitcoins in circulation in the world, making it easy for them to manipulate their price. Today, for example, one bitcoin whale moved 94,504 BTC, worth more than $1 billion outside any control or supervision and paying just $700 in fees.

The absence of any distribution mechanism for most cryptocurrencies beyond “I believe it, we’ll see what happens later,” has allowed schemes to emerge that jeopardize the future viability of its use, generating a highly problematic and volatile ecosystem.

China is obviously a very different case. It has started by breaking one of the rules of most cryptocurrencies by proposing strong centralization and state control, no surprise there, so as to avoid any problems, while at the same time, emphasizing the transactionality and efficiency necessary to deal with the many transactions of its vast economy, and abandoning blockchain on the grounds it is too slow and expensive: in short, Beijing will exercise iron control over the new currency.

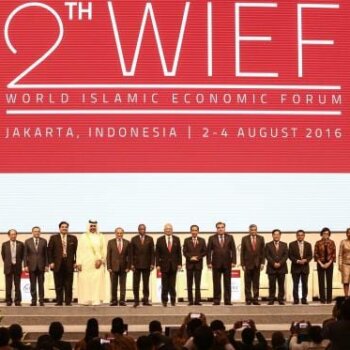

To this end, China has designed a process involving the four major state banks in the country (Industrial and Commercial Bank of China, China Construction Bank, Bank of China and Agricultural Bank of China), the credit card organization that includes all the country’s banks, Union Pay, as well as two technology giants active in the financial world, Alibaba and Tencent. Those seven institutions, and possibly an eighth to be decided, will receive the new assets when they are launched and will put it into circulation, possibly to coincide with one of the country’s major commercial events, which could be next November 11, Singles’ Day. The idea is to reach the 1.3 billion citizens who currently use the renminbi, providing reasonably fair and equitable access.

Will China become the first major economy — we won’t even mention Venezuela’s petro — to steal a march in launching a cryptocurrency while everybody else is still trying to understand how they work? The move could give the country a long-term strategic advantage in the financial markets.

This will be the first mass use of a transactional cryptocurrency and will be watched closely around the world, particularly how Beijing deals with privacy and what its population decide to do with it. There is also the question of how the new currency will be integrated into the global financial system.

This also raises the question as to how long the renminbi will remain in circulation, what effects such a massive transition will have on such a huge population, as well as how many people decide to start using it. In short, it’s going to be a game changer in China. It will be fascinating to see how a highly centralized state maintains control over a form of currency that until now has been characterized by volatility and that for most of us is still an unknown quantity. The implications and scope of such a movement by such an important actor as China are hard to imagine, but worth making the effort to.

About the Author

This article was written by Enrique Dans, professor of Innovation at IE Business School and blogger at enriquedans.com.