Key Takeaway:

The current economic climate is particularly concerning for young people, who are often financially worse off than their parents. To overcome this, it is important to understand one’s financial attachment style, which can be secure, anxious, or avoidant. Attachment theory, influenced by childhood experiences and education, can help shape one’s relationship with money. Identifying attachment styles can help nurture a better relationship with money and provide confidence. Recent financial trends on social media can also provide insight into attachment styles. Therapy and support can help adopt healthier habits and increase financial knowledge.

The current state of the economy is particularly scary for young people. Unless you were born with a trust fund (not most people), you are likely part of the first generation to be financially worse off than your parents. Retirement seems like an impossibility, and you’re unlikely to own your own home. Eighty percent of people in their early 20s worry about not earning enough.

It is important to start planning for your financial future early in your career, but you may find it overwhelming. The good news is, there are ways to overcome this.

Finding your financial attachment style

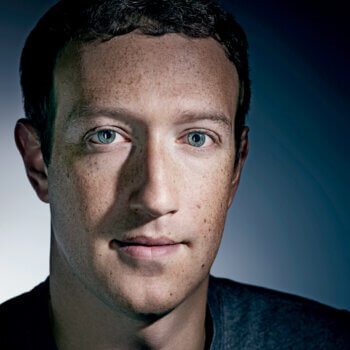

As a psychotherapist and finance researcher, I work with people to help them to increase their financial confidence and find the motivation to start planning. This often starts with understanding what influences their relationship with money.

Attachment theory is a psychological concept introduced in the late 1950s. Your attachment style – which can be, for example, secure, anxious or avoidant – explains how you approach creating emotionally intimate relationships with other people. Some people feel secure building relationships, while others are extremely anxious. Some avoid close relationships altogether.

Attachment style can also apply to your finances. If you feel confident and safe when it comes to money, you are secure in your relationship to saving and spending. But if the thought of opening an ISA or filling out a tax return, let alone planning for retirement, fills you with dread and panic, you may be anxiously attached. And if you if you push money worries to the back of your mind, you are likely avoidant.

Attachment theorists and psychotherapists like me think that attachment styles are shaped by childhood experiences – for example, how well you were looked after by your parents or carers, and how safe and loved you felt.

The way money was handled in your family growing up is likely to have set the blueprint for your financial attachment style. Outside influences like education or work experiences may shape this too.

Although financial education is part of the school curriculum, 76% of children leave school without sufficient financial knowledge to manage their lives. Similarly, financial services like banks have done a poor job helping people establish secure financial relationships. Complex and off-putting language has placed a barrier between those who know about money and those who need to learn.

If you feel unable to keep up with financial terms, or that you don’t understand money, this is likely to hurt your confidence in your financial planning abilities and fuel a more avoidant attachment style.

Identifying your attachment style can help you nurture a better relationship with money. You will be able to understand and predict how and why you react to finances in certain ways. And, it can provide confidence by reminding you that money struggles are not necessarily your fault.

Getting over financial anxiety

Some of the recent financial trends spreading on social media may give an insight into your attachment style. Are you “loud budgeting” (being vocal about why you aren’t spending money)? This could be a sign of financial confidence and that you have secure financial attachment. Or are you “doom spending” (spending money you don’t have instead of creating a nest eggfor the future)? You may be avoidant.

Healthy relationships with people and money are both critical for our survival and mental health. As an adult, you have the power to improve these relationships. But because attachment patterns were formed early on, they are difficult to change. Therapy and other support can help you adopt healthier habits, as can increasing your financial knowledge.

If you want to change your relationship with money, you should try to be mindful of what may be influencing you. While financial advice on social media may be useful and help young people feel more empowered to talk about money, it can also increase anxiety further and be full of misinformation.