Key Takeaways:

- Recent rallies in stocks popularised on social media have attracted increasing numbers of investors looking to these so-called “meme stocks” for quick returns.

- And with recessions looming around the world, the danger is becoming even more acute.

- Investors should learn a lesson from the GameStop story.

- Consumers have learned to be more wary about promises of unrealistic and scientifically impossible results for all kinds of products – a similar precaution should apply to investments.

- As shown by recent research on GameStop, social media is very effective at sparking extreme rallies in a meme stock, but it does not protect retail investors when the price drops back to its fair value.

Recent rallies in stocks popularised on social media have attracted increasing numbers of investors looking to these so-called “meme stocks” for quick returns. But while it might look like a fun game, there are real risks to investing in stocks and other financial products popularised on social media. And with recessions looming around the world, the danger is becoming even more acute.

The term meme stock was traditionally used to describe any share that receives a lot of attention on social media. One of the more notable recent examples of a meme stock, retailer GameStop, saw its stock soar by more than 10,600% in 2021 following discussions by individual investors on r/WallStreetBets – a popular subreddit on the Reddit social media platform. You’ve probably heard about other instances of assets popularised on social media of late, including cinema chain AMC and US retailer Bed Bath & Beyond.

Meme stock rallies have also boosted cryptocurrency products, such as stablecoins and non-fungible tokens – basically any assets for which hype has been built online. And while these new decentralised finance assets are very different to stocks, the way sentiment is formed about these assets on social media tends to be the same.

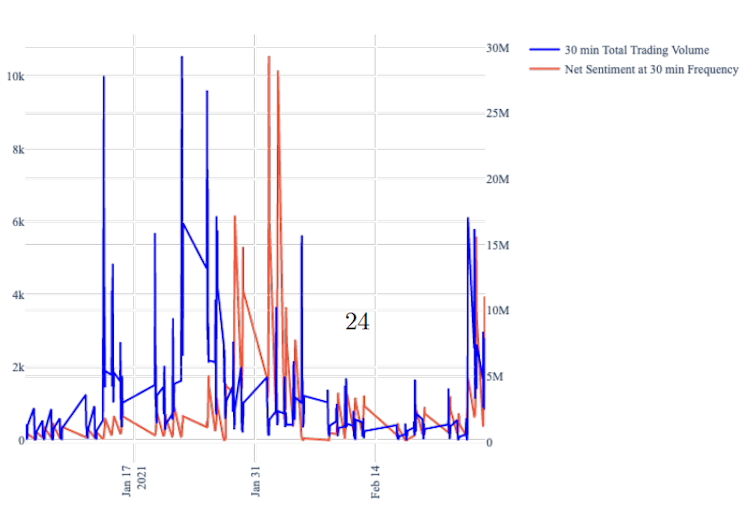

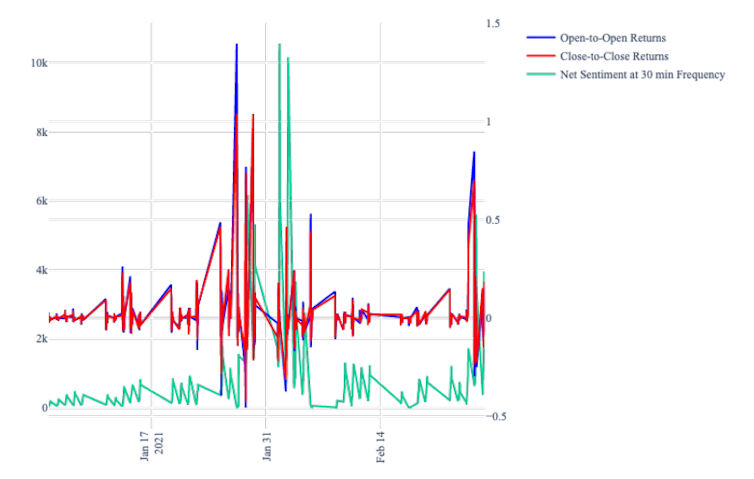

Recent research I carried out with colleagues aimed to understand the role of Reddit in the GameStop share rally involved a textual analysis of 10.8 million comments on r/WallStreetBets and high-frequency GameStop prices. What we found sends a warning signal to all meme stock investors: online chatter pushes prices up but can’t save investors when asset values start to collapse.

Our analysis showed that online discussions – or “net sentiments”, as shown in the chart below – on r/WallStreetBets helped to initiate GameStop’s price growth and caused a spike in trading volumes during the bullish market for this stock when the hype was high.

But we found that positive comments by people on Reddit could not prevent GameStop from falling when people started selling. In early February 2021, online sentiment was growing, that is, there were more positive comments about GameStop than negative on r/WallStreetBets, even as investor returns for GameStop stock (recorded at 30-minute intervals for our research) kept falling and trading volume decreased.

Investors should learn a lesson from the GameStop story. When online commenters are trying to hype a stock, they will often add hashtags such as “to the moon” and HODL (a misspelling of “Hold” – as in hold the stock rather than sell – that has become an acronym for hold on for dear life in the online trading world). But if the price starts falling, it does not matter how many of these hashtags are in the comments on a subreddit, our research shows the wider market reaction to the price decline will outweigh any encouragement made on investment forums.

Don’t believe the hype

Social media often feeds both overconfidence and confirmation biases – probably the most common cognitive biases in business and finance. When reading investment forums, amateur investors are often searching for confirmation of their own decision to invest in a meme stock. These investors then often simply feed each other’s biases by sharing information that confirms this desirable outcome.

And there is even more risk involved in investing in cryptocurrencies versus equities. Crypto markets are volatile and lack sufficient regulation to make them more stable. The recent collapse of Terra Luna , for example, saw individual investors lose their savings after investing in the algorithmic stablecoin.

With inflation climbing amid an energy and cost of living crisis, the cryptocurrency market has struggled to recover quickly from its most recent collapse, with the market leader Bitcoin losing 70% of its value since November 2021. But even these factors have not deterred amateur investors from seeking returns in crypto markets.

Aside from waiting for governments to tighten crypto regulation – as is planned in Singapore, for example – there are a few steps that retail investors can take to protect themselves from meme-stock mania.

1. Beware when something sounds too good to be true

If an asset or stablecoin claims to be low risk, but investors are bragging about enormous returns made in no time, this is a red flag. Such claims are usually too good to be true, since there are no risk-free assets that can offer high returns. Investors should check the yields of the US three-month Treasury bills to shape their expectations of potential low-risk returns.

2. Carefully consider a range of information

It does not help to read ten articles that support your own opinion and quickly scan through headlines that suggest the alternative. Consumers have learned to be more wary about promises of unrealistic and scientifically impossible results for all kinds of products – a similar precaution should apply to investments.

3. Pay attention to sources

If an article or analyst’s opinion has been sponsored by a crypto firm or exchange, this information is the same as any other paid-for advertisement. Investment forums and social media are not trustworthy sources of investment tips either, they are full of bots and can be used as an inexpensive marketing tool for crypto firms looking to manipulate the market.

As shown by recent research on GameStop, social media is very effective at sparking extreme rallies in a meme stock, but it does not protect retail investors when the price drops back to its fair value.