Asia is rapidly evolving its Financial Services industry to reflect the local customer behaviours and operating infrastructures. Given the growth of new technologies and communications, mobile being the most powerful, there is an imperative need to implement world-class customer service that can rapidly accommodate the demands of the new generations of customers.

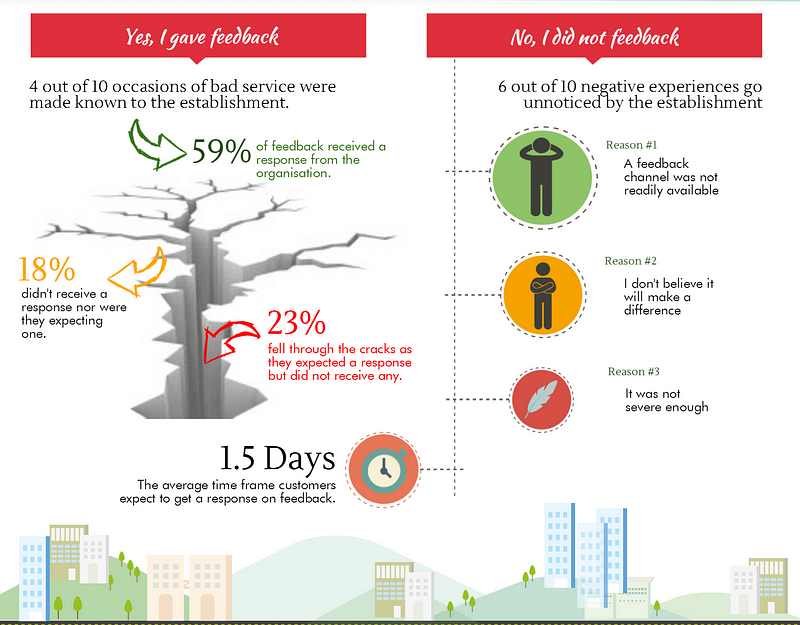

In Singapore, startups are driving the national vision of using technology to improve the quality of life of the people in the country. In addition to the Smart Nation vision, Singapore is also pursuing customer service excellence for the last few years, and not with the best results yet. To give an example, one of the consequences of bad customer service it’s what Accenture call the “switching economy” that cost Singapore firms US$16b in revenue in 2014. Another consequence is the manifested dissatisfaction among consumer that have stopped giving feedback, as we can see in the IPSOS infographic below:

Consumers in Singapore are demanding excellent customer service at the same time that they are changing their spending behaviours by increasing online and mobile payments, and moving towards a cashless society. New consumer habits require a new mindset from organizations, especially in financial services. FinTech startups are born as customer-centric organizations and have a significant advantage over the archaic models of the big institutions that have maintained the old “one size fits all” customer service mindset for decades.

How can startups and “the customer-first mentality” help Singapore to reach customer service excellence?

What are the winners doing to be ahead by implementing world-class customer service?

Changing how to engage with customers

- Keep the human touch. Get rid of automated scripts: When you talk payments you are talking about: People, families, dreams, education, holidays, jobs, etc. so don’t talk like a robot. Talk with your customers like they are next to you in the same room. Reduce waiting times and increase first contact resolution. A beautiful example is Simple Bank from the US.

- Create a tailored experience for all the customers: Use data to make a customized experience and understand customers’ needs. Your customers will feel unique if you know when, where and how to interact with them and you will build longer-term relationships. Furthermore, by using the right data to know your customer, you will significantly reduce the number of unnecessary questions you need to ask and go straight to the point because you will already know the answers.

- Be proactive and anticipate customers’ questions: Customer service used to be a reactive function. Now that is no longer enough, and proactiveness is a must for customer service and a differentiated factor for companies. Whether, it’s proactive WhatsApp notifications, proactive rewards or content; proactive engagement will help you to learn and anticipate customers’ needs, prognosticate customers’ future behaviours and increase customer loyalty.

- Promote local customer service: Singapore has four official languages: English, Malay, Mandarin, and Tamil. English is now the language used in business and the education system. However, almost all Singaporeans speak more than one language. Knowing the language spoken by your customers is critical to communicate clearly and lift any language barriers. Allow your customers to talk to you in their preferred language. Align your culture and values with the culture and values of the community to gain trust, empathy, and build stronger relationships with your customers. The Indian FinTech Bharosa Club and its unique idea of “Empowering Households — Make billions by serving millions”, use regional distribution teams also to serve as local customer service agents (via phone) to solve local issues in a local way across India.

Introducing innovative models of problem-solving

- Empower employees to go above and beyond what’s expected: Hire the right people. Provide your employees with the best training, inspire them to be creative as part of their job and give them the freedom to innovate and make decisions. A creative person will create solutions but also experiences that can encourage word-of-mouth praise. If they feel empowered, motivated and happy, they will do whatever it takes to resolve a problem and to satisfy a customer.

2. Build a self-service FAQ for the DIY customers: In my first point, I talked about how important it is to keep the human touch, but this point is about allowing your customers to self-resolve their issues with no human interaction. For the first time, web self-service has become a preferred channel for customers to get questions answered. It comes as no surprise if we think that millennials have grown with technology at their fingertip, and they would rather use technology and skip the customer service agent to self-resolve their queries. A web self-service with relevant content will increase customer satisfaction and decrease email and phone contacts. Venmo, the PayPal company, updated the help centre few month ago after popular demand.

Millennials in Singapore represent the 22 percent of the total population, around 1.2 million.

3. Make your How-To content: Googling How-To content is almost an everyday routine to resolve problems. When the search is related with companies or products, most of the time you end up on a third party forum, blog or a YouTube video. Companies can actively collect data or feedback from different channels to identify recurring issues and create their How-To content to build credibility and improve brand trust. Here is a good example of Square Youtube’s channel.

4. Backing the power of the crowd: Crowdsourcing as a model of problem-solving as part of a customer service strategy. Companies can leverage the power of their customers by creating an open community where customers participate writing reviews, sharing knowledge to help fellow customers resolve queries or ideas that can lead you to innovation. The community needs to be monitored by a customer service team to assure that users are creating value to others. Open the community to free and honest reviews and feedback, positive and negatives. Here is an example of the PayPal-community.

A different approach to building your community it’s what Banks and other companies are doing in Ireland’s largest online community forum. Boards.ie is a famous open community that reaches approximately 20% of the total Irish internet audience users. In 2012 Bank of Ireland (BOI) was the first company to join the community as part of its social media strategy. BOI realized that customers were seeking advice from other customers on Boards.ie, so they join the community on the “Talk to” section, in their words: “Customer support powered by Bank of Ireland representatives and Boards.ie community members.” It is also an example of how to engage with “local customer service” adapting your strategy to the channels chosen by your local customers.

Create power users and let them be the voice of your brand, remember that brand advocates are companies biggest asset. Create a reward program giving away online badges that can be shared on Linkedin, Facebook or any other social platform. Or in a more human way: Organize a social event to meet them personally, send thank-you cards now and then, birthday wishes or even Chinese new year greeting cards. For instance, a startup focusing on helping families to manage their expenses in Singapore can constitute an open community platform where digital mums, as the chief household decision makers, can share household experiences, best practices and help each other to resolve issues related to the products or services.

Communities are more important than ever! In Singapore for instance, the number of mums likely to use online communities for advice has increased by 20% (Source: Asian Digital Mum Survey 2015).

Changing the game with a multi-channel strategy

- Adopt everyday instant messaging: Take advantage of instant messaging (IM) and communicate with your customers the way they like it, and use every day. Instant messaging allows real human one to one conversation, it is faster for resolving issues, provides richer brand experience and reduces the cost of contact. Not to mention that Whatsapp now has as many users as Gmail. An example of a FinTech using WhatsApp for customer service is the largest FinTech in Kenya, JamboPay that has facilitated more than USD 40 million in revenue collection, helped to fix one of the biggest problems in Nairobi.

- Championing social customer service: For some time, social media channels have been used as a go-to channel for the unresolved complaints raised first by phone or email. Customers used social media and its visibility to elevate public complaints and put pressure on organizations.The social customer now uses social media as its preferred channel of communication, whether to express gratitude, suggestions or to get issues solved. They expect rapid response and same-channel resolution. Organizations should offer seamless assistance and a consistent voice across all social and communications channels. Some subjects are too sensitive to be discussed publically in social media, in the situation where you need to redirect your customer, do it nicely: One of the trends in customer service is personalized click-to-call links on Twitter. A customer that needs further and private assistance will receive a custom link to make a call to a representative that can handle the issue. After the call, the link and the number become inactive.

- Live face-to-face video chat: This channel brings a unique opportunity for FinTech companies with no physical locations. Video chat allows a natural human to human communication experience. Multi-platform, with no location restrictions and extremely helpful features like screen sharing. For instance, when troubleshooting over the phone is not working, screen sharing can be extremely helpful. Additionally, by asking customers to walk you through how they use your product can help you to identify points of friction. Face-to-face video chat can also be use for compliance purposes making it easy for FinTechs to comply with regulations. The acclaimed “European most modern bank account ” the German Number26 use IDnow for the online verification process, allowing anyone to open a bank account in 8 minutes.

Conclusion

The difference between average and excellent customer service starts way before having any customers; everything begins with the culture and values embraced by the company from day one.

Customer service is changing rapidly from the traditional outsourced call centre to a strategic high-touch multi-channel to engage with customers, and the startups that aspire to win must own customer service to be ahead of the game.

Singapore residents are getting inspired by the innovation and technology that FinTech startups are bringing to improve their lives; I believe they can also benefit from the customer-first mindset to improve how they are beeing served while enjoying the comfort and benefits of technology.

Thank you for reading!

__________________________

About the Author

This article was written by Jose Diaz of Yolopay. Jose Diaz is an ex-PayPal employee, an expat in Singapore and the Head of Customer Relations at YoloPay #YoloLite. see more.