Here’s why the Gamestop Fallout Is a Good Thing

In the age of extreme polarized political talk, an entirely new phenomenon is sweeping the trading world off its feet. As they call it, Meme Stocks are stocks targeted by inexperienced retail investors with the intension to prove a point. GameStop became a symbol of the resistance and solidarity against the Wall Street establishment.

The memes, repurposed as investment tips, are part of a suite of activities adopted by a new generation of young financial activists. These millennial activists were reared on the internet, and lived to see their parents struggle through the 2007/08 financial crisis, where hedge fund managers pocketed billions.

Now, hedge funds are on the losing side of this equation. Is it a coincidence? You be the judge of that. One thing is certain, the meme stock showdown is a sign of things to come. The people behind this resistance are savvy about making their struggle resonate with the little guy. Here’s how it can end.

Stock Shorting Explained – How much can you make?

A time comes when investors become convinced that a particular stock is falling out of favor with traders. Usually, this can be a result of weak fundamentals that foreshadow a fall in stock value. With that in mind, investors, typically hedge funds, individual investors, and professional short sellers, make their bets.

The money they stand to make when the stock falls instead of going up is quite high considering the risk involved. This practice is called short selling. It is designed to give the investor significant returns if the share prices fall. Likewise, short selling possess great risk to the investor if the prices go up.

To short sell a stock, investors borrow shares of the target company that they don’t own and sell to willing buyers. Once the stock price falls, they buy back the shares at a lower price. If they made the correct bet, they can payback their debt obligation and make a handsome profit.

The amount of money one can gain or lose from such a transaction varies from one stock to the other. Michael Burry of Scion Capital made a short on the housing market that paid off by 400%. On the other hand, Gabriel Plotkin of Melvin Capital lost close to a half of the value of their assets under management on GameStop.

So, why would a hedge fund manager bet billions on a stock like GameStop, AMC Entertainment, Bed Bath & Beyond, and Blackberry? For instance, Blackberry has been forced to alter its business model since smartphones, iPhones in particular took off. The company has experienced little revenue growth and profits have been on a downhill spiral.

AMC Entertainment was already standing on shaky ground with strong competition from Video-on-Demand platforms when the virus hit. The COVID-19 lockdowns pushed consumer to online streaming services like Netflix, Amazon Prime, HBO, Disney Plus, and more, further suffocating the company.

The Reddit Angle

GameStop, the poster child of this whole debacle, had been on its death bed ever since e-commerce exploded mainstream. Even before shelter-in-place guidelines kicked in, the final nail seemed ready to be dealt on GameStop’s coffin. It showcased a textbook case of a perfect short selling opportunity.

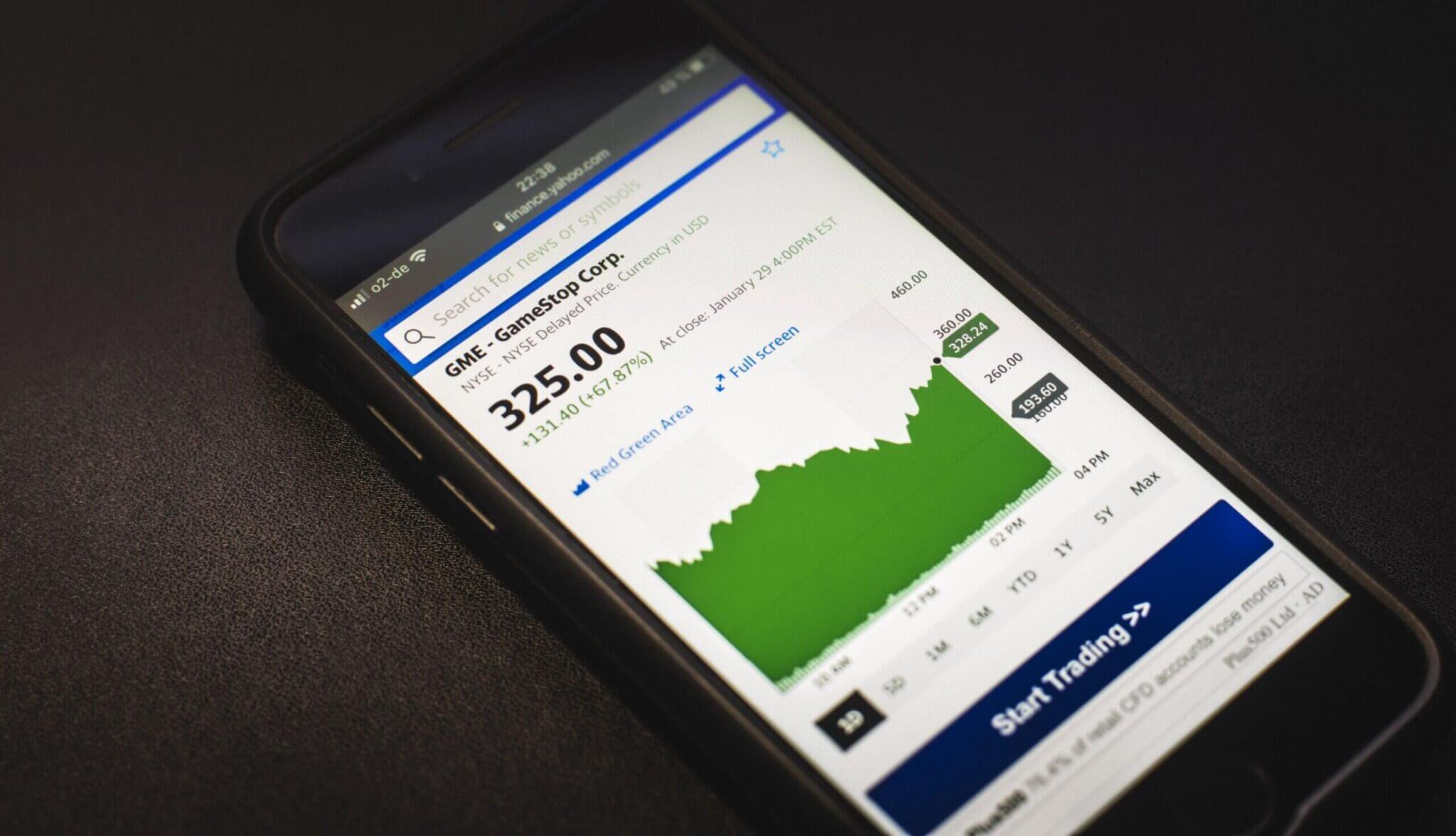

However, small time investors were not going to have any of this. Just as Wall Street insiders settled in with billion-dollar bets, a wave of capital injections kicked in and everything fell apart. GameStop shares closed 12th January at $20 only to rise 15 time over ten days later.

The meme stock movement lacked the hallmarks of an organized resistance, but it sure looked like it did. Keith Patrick Gill, also known by his user name “DeepFuckingValue” is a former insurance marketer turned Reddit influencer. Gill’s discussions about GameStop had a significant role to turn it into a meme stock. Before GameStop, Gill used his “DeepFuckingValue” handle to comment, share, and rally his followers behind his stock market prediction.

It’s not clear whether how much was made or lost from betting on his advice. Somehow, he helped attract a flood of cash from retail investors, thereby burning hedge fund bets. As high GameStop posted begun to pick up steam among Reddit users, it got a major boost from Elon Musk, sending share prices up 157%.

Now congressional representatives want Mr. Gill to testify on his role in the GameStop frenzy. In the meantime, Gill continues to share on Reddit and YouTube his investment advice to help others get on track to success.

Robinhood, the Political Gamble, and the Bitcoin Way

As GameStop debate ensued, Robinhood, the preferred financial service provider of many of these ‘YOLO’ investors. The company, whose mission is to provide everyone (rich and poor) with access to the financial market, restricted trading of affected stocks. Many interpreted this politically correct decision as Robinhood choosing its billionaire investors over its millions of users. After all, the company needed the backing of its billionaire friends to launch a successful IPO. It is possible that the strong and widespread negative reaction to their decision to restrict buying may impact that $11 billion IPO. For the time being, the world is yet to see who will be the first to walk out the door.

The party lasted a little over two weeks. It climaxed with new and former millionaires, ruined hedge funds, and stunned politicians feeling the impact. The message was clear; governments and state agencies are looking out for the rich, the rest of the population are on their own. Could there have been a better way? Yes. Bitcoin offers a public ledger that could have limited the power this short sellers wielded. That’s why many people are buying bitcoin as a symbol of their simmer displeasure with the direction everything took.

Bitcoin is the bellwether of all anti-government sentiments. The world is staring at a tug of war bloated between states and the power of the people compounded under the potential of bitcoin. The power of the rich continues to grow and it’s only a matter of time before the economic and market revolts erupt.

Many dress bitcoin as the doomsday currency. However, it’s more of a symbol of the resistance and solidarity of people worried by government over-stepping boundaries. It progresses through the eyes of the people- a force of good.

Final words

Fresh off the success of the GameStop raid, Bitcoin is seriously attractive for anti-establishment Redditors right now. Since money acts as the center of power for billionaires and sovereign actors, people are opting out in favor of bitcoin’s non-sovereign, decentralized system.

Besides, bitcoin was born out of a movement by the people. With this perspective in mind, it comes as no surprise that bitcoin is breaking boundaries. It’s a meme-driven drive to remove the power of money; the most authoritative weapon for the rich and those in power.