Sales is hard… and there are plenty of exciting software startups out there who consistently fail to cut through the noise. Inexperienced sales teams lose out to larger, more mature vendors with vast resources and well-honed processes (despite offering a superior product.) Or they get killed by the prolonged sales cycles, which can be byzantine in some industries.

A “Sales Playbook” is a useful approach that can help startups combat these challenges as early as pre-seed and seed. It is useful in refining their sales proposition and mapping out their process with a view to improving consistency, conversion rate and speed.

* Because closing a high-profile VC deal is like closing a complex enterprise sale, we have included examples in this article from our own experience of developing a hypothetical sales playbook “for investors”.

Key takeaways

- Software startups can use a “sales playbook” to map out and refine their sales process, as well as improve consistency, conversion rate and speed.

- Across prospecting, propositioning, qualifying and closing, it’s the sales proposition (“who is buying what from us and why”) where most startups fail.

- Customer personas help you define your “ideal customer” situation, whilst org charts also help to identify ‘champions’ or ‘saboteurs’ within the company.

- People buy things for emotional and political reasons, yet justify decisions with logical and financial ones. This is fundamental to the “So, What?” question with each sale.

- Create a dynamic “crib sheet” that helps to pre-empt and manage objections.

What’s so hard about enterprise sales?

If you’ve never done it, sales is a professional skill-set that requires some training.

To some, it may come naturally, particularly to the street-smart, or what are called “pathfinder” salespeople – clever folks, hard to come by, who typically develop their playbook on the fly. While they’re great to get you started, they often become difficult to work with at scale and typically don’t sell the product that actually exist, hence often disappointing customers.

On the flip side, hiring an experienced VP of Sales is prohibitively expensive and even hiring good salespeople involves big money and a high degree of churn. Most startups must, therefore, rely on inexperienced sales “mavericks” who require support and mentorship that’s not readily available.

Cue the sales playbook…

What is a sales playbook?

A playbook is an American “football” term describing various “plays”. Effectively it is a book of diagrams explaining how everyone is going to play together to score a touchdown.

Borrowing sports terminology, a sales playbook simply means your “written down tactics for making sales.”

While it will already exist in some form (otherwise you wouldn’t be “playing” at all), it’s likely that a different and incomplete version of it exists in the minds of everyone. This is not the route to optimal teamwork or evolving sales tactics as quickly as possible.

Assuming the aim of the playbook is to win and close sales and be the first and the best choice for customers, the challenge is two-fold:

(i) making your offer compelling in the mind of the customer (the proposition) and

(ii) improving customer conversion at each stage of the sales funnel (sales process).

Optimising your Sales Process

The sales process can be broken down into 4 stages:

- Prospecting – lead generation (probably the one way you can differentiate yourself as a salesperson, (although that’s the topic of a different article).

- Propositioning – the conversation that creates a compelling reason to act or engage in the mind of the customer.

- Qualifying – understand how likely an opportunity is to close (on favourable terms), and what the optimal next steps are at any time

- Closing – getting the deal, assuming you are going head-to-head with competitors, it can involve both objection handling and managing exceptions.

By mapping out each step of your current process and collecting insights across the team, you begin to share best practice, observe gaps or inconsistencies and explore ways of improving it. This includes questions such as how did that lead to a sale and what did that customer like at that point or why did another fall through?

After mapping out our typical deal flow funnel as an investment team, it was fascinating to share individual experiences and approaches (i.e. the questions we ask founders and the impressions we leave) at different stages.

In particular, once we had gathered feedback from a variety of founders, we instantly saw an opportunity to inject more propositioning into the process, given that most investors spend too much time “investigating” and not demonstrating their value add.

This included an entirely new step before terms, which included “showing not telling” with 1:1 meetings across the product team or spending time getting to know each other in more informal settings, to discuss business challenges and already establishing a partnership.

Refining your Sales Proposition

The sales proposition is just as much about understanding and attracting a range of customer ‘types’ or personas, as it is about employing techniques that help you to differentiate your product or service offering versus competitors. As part of this, it often involves the team sharing common “handling strategies” of customer objections.

In a nutshell, the sales proposition is “who is buying what from us and why”

Step 1: Who?

Who is most likely to buy from you in terms of target organisations? What are the characteristics of your ideal customer? What needs to be happening in that organisation for a compelling need to arise?

This step involves mapping out ideal customer personas, understanding their needs, wants and motivations, as well as understanding the ideal situation. It helps to map out the organisation, which you are selling into, (particularly when multiple stakeholders are likely to be involved in the decision) and brainstorming who you think might champion or sabotage your sales efforts.

Let’s take the example of XYZ “cloud accounting software”. A brand new package might present instant benefits to the Financial Reporting or Accounting & Bookkeeping team (“Champions”).

However, it might also conflict with any existing software infrastructure that is not supported by the Systems Support team or require additional set-up and training.

Alternatively, it might be the compliance team who block it simply on the basis that your startup is not a well-established entity.

Step 2: Is Buying What?

Note the word “buying”. This part of the Playbook is all about the mind of the customer. It’s about what they are buying and not what you think you are selling. Those two things can be surprisingly different.

In this exercise, it helps to outline the top 5 known likes and dislikes of your proposition. Revisit the “job to be done” framework or “job map” for your customer, pinpointing exactly what functional, emotional and political benefits you are providing.

Worth noting that sometimes, there are elements of the product that are simply deficient (maybe to the extent that no matter how hard you sell, you can’t get any customer buy-in). This is a product problem and it’s all important feedback that you must report back to the product team before taking further steps.

Step 3: “and Why?”

Having thought through the proposition and who is buying what from you, you now need to think about competitive positioning and why the customer should buy from you rather than going for another option.

The vast majority of this is simply objection handling and it’s important to understand what is going on in the minds of the customer, as well as the detail of which alternatives exist to them in order to help you position your offering.

This can be both an exercise of educating the customer (highlighting the benefits) but also casting fear, uncertainty and doubt (FUD) in their minds, that going for any other option would be madness.

This feels somewhat mercenary but even the most bluechip companies use these tactics to win-over potential buyers. Remember “No one ever got fired for buying IBM”. Where do you think that came from?

When faced with objections, each member of the sales team should keep track of them and attempt to spot patterns across what worked (or what didn’t) in different instances. In the interest of time, it’s important to spot ‘time wasters’ and clear binary reasons for objecting (i.e. getting to a quick no) in order to move on and select those potential buyers out quickly, so you can move on to the next.

In our case, founder objections typically relate to terms of investment and as opposed to employing sales tactics or “FUD”, we prefer to emphasise our own merits and provide a degree of knowledge sharing. That said, it’s still a useful exercise to outline firstly the objection, followed by a variety of handling strategies.

For example, if a founder believes they will get to Series A, no matter what happens, they might decide to take the most money at the least dilution possible. In that case, it’s our job to highlight that, as a VC with an agency inside, the execution support we can offer gives them a 2.5x higher valuation when they reach that stage.

Hiring and incentivising

Finally, a brief note on hiring, incentivising and (if necessary) firing early sales hires.

In the same way that you might use a metrics-driven approach to experimenting with different online marketing tools or channels, it’s important to evaluate the ROI of your sales team and have a good handle on sales cycles. To put it into perspective, when celebrating an annual sales contract of £15k that took 3 months to close, bear in mind you’ve most likely spent ~£18k (i.e. 3 x £6k full-loaded monthly salary) towards a sales rep.

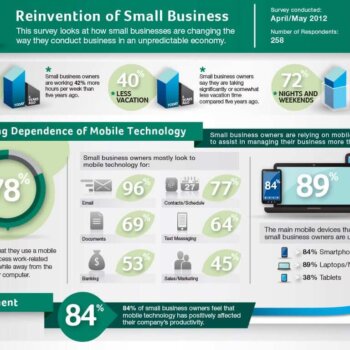

To that end, our Head of Talent has a handy example of modelling out target earnings for a senior sales hire. It highlights the potential payback period for different incentive structures as well as the potential cost of getting it wrong.

Hence the advice to “hire slow and fire fast”.

Further reading:

- Matthew Dixon, The Challenger Sale: Taking Control of the Customer Conversation(the preferred methodology for most Silicon Valley software startups, promoting a highly-tailored “use-case” approach to selling into enterprises)

- Jen Blount, Objections: The Art and Science of Getting Past No and Sales EQ: How Ultra High Performers Leverage Sales-Specific Emotional Intelligence to Close the Complex Deal (writes more on the psychology of the sales process and appealing to the political and emotional motivations that drive people)

- Daniel Pink, To Sell is Human: The Surprising Truth about Persuading, Convincing and Influencing Others (“Parents sell their kids on going to bed. Spouses sell their partners on mowing the lawn”… a timely reminder that (whether we like it or not), we’re all in sales some way or another)

- James Muir, The Perfect Close: The Secret To Closing Sales – The Best Selling Practices & Techniques For Closing The Deal (I particularly like this one given James originally coming from a technical background and later moving onto the sales side. The way he maps out the sales process and the constant use of the phrase “Does it make sense to move forward” is a polite way of selecting people out when necessary.

About the Author

This article was written by Chris, Investor at the Path Forward. The Path Forward was developed by Forward Partners, a VC platform that invests in the best ideas and brilliant people. Forward Partners devised The Path Forward to help their founders validate their ideas, build a product, achieve traction, hire a team and raise follow on funding all in the space of 12 months. The Path Forward is a fantastic startup framework for you to utilise as an early stage founder or operator. The framework clearly defines startup creation as being comprised of three steps. The first step of this framework involves understanding customer’s needs.Chris previously founded growthsquared.io a data science consultancy on a mission to help e-commerce businesses apply advanced analytics to their data and/or operating model. Before that, he was Head of Analytics at Swoon Editions, a business championing the “zero stock, zero lead time” model in online furniture retail. Chris undertook a PhD in organisational economics at Imperial College London, focussing on how public and private organisations structure themselves to deliver affordable energy services to the poorest parts of India and East Africa.