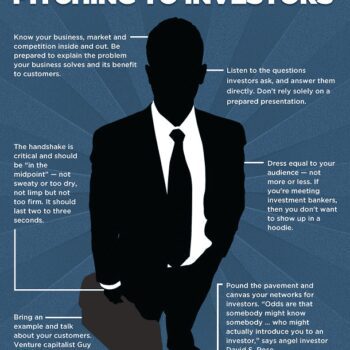

There’s been a lot of chatter in the press about the unbridled energy of a 20-something teaming up with the adult supervision of an MBA as the new formula for success. Some enterprising researchers have found a correlation between the two, and in the world of startups, correlations lead to funding trends. The poster child for this potent combination is 10 year-old Facebook, with the now 29-year-old CEO Mark Zuckerberg teaming up with the 44 year-old MBA-holding COO Sheryl Sandberg.

The numbers have always favored experience over enthusiasm, and despite the current hype around undergraduate investment funds, seasoned investors seldom back inexperienced teams. Recent data from a Kauffman Foundation study found the highest rate of entrepreneurship and innovation in America shifting to the 55-64 age bracket while declining amongst those under 35. Jeff Bussgang did a great blog post visualizing a study on “unicorns” (fast-growth startups that have exceeded $1 billion in revenue) and tracking the combination of MBAs in founding and management teams (the column titles indicate positions held by MBA holders at each company):

The data is overwhelming, and a reinforcement of what was already known: The likelihood of success is far greater with experience. This means nothing has changed for investors who have always prioritized the team as the primary investment criteria. So regardless of your age, if you want to join the next cohort of unicorn companies, be sure you have experience and MBAs on your management team.

written by Dr. Rob Adams, who teaches in the McCombs MBA program and is the director of Texas Venture Labs. See more