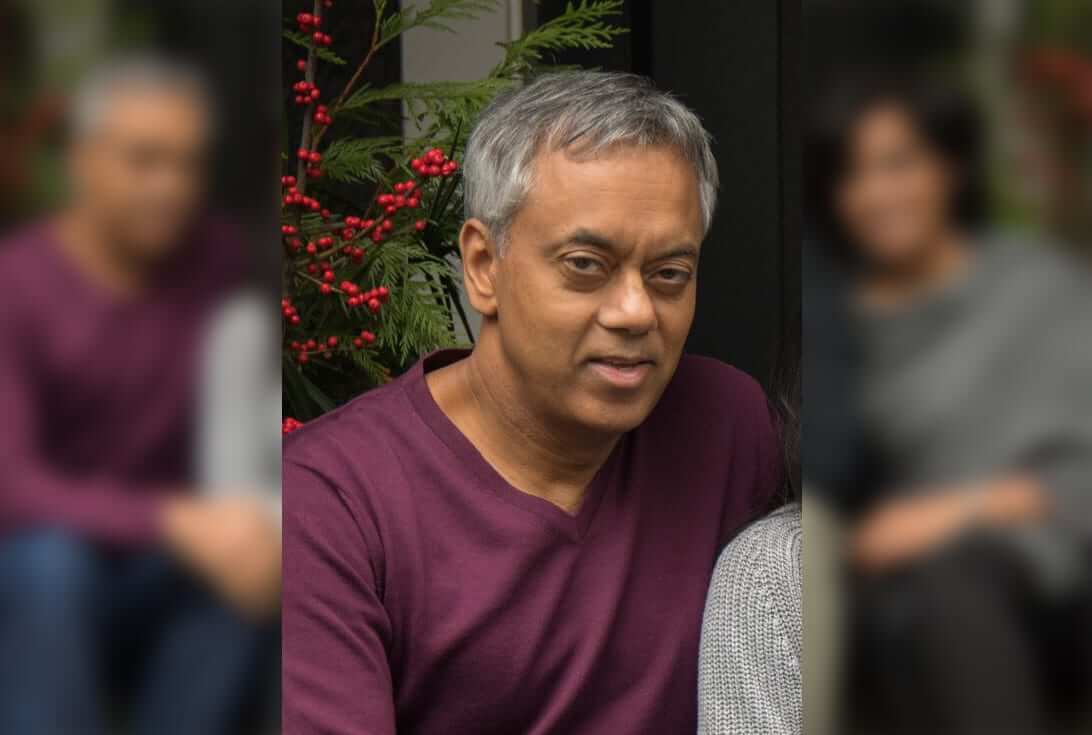

Praveen Varshney is a Director of a Vancouver-based, family-owned venture capital firm.

What’s your story?

I was born on the floor of the kitchen of a mud hut in a village in India, moved to Vancouver, BC Canada at age 5, and have done all my schooling and career living in the beautiful city of Vancouver. After my business degree at The University of BC (UBC), I became a CPA at KMPG, after 5 years I joined my Father (also a CPA) & my younger brother (a securities lawyer) and became an entrepreneur. We started 4 companies: a diamond mine, a casino company and 2 tech companies. We had great success with exits taking them public. With the capital, we formed our family office, Varshney Capital Corp.

What is your involvement with Investment?

For 25 years, we’ve been investing through our family office in a variety of sectors ranging from mining/resources, all areas of real estate and social impact/tech, mostly in companies in our region but while all start locally, they’re all thinking global.

How did that come about?

As an entrepreneur, I started 4 businesses, 3 were very successful exits, with capital at disposal we set up a family office to make active investing our full-time profession (as opposed to putting capital with outside money managers to let them do it). Our belief and since proven numerous times, we’re the best at managing our own money and making returns that outside managers wouldn’t be able to make. Plus it’s more fun & more rewarding actively working with entrepreneurs to help them grow their businesses & exit.

What are some of the key things you have learnt about Investing?

To use a poker term, it’s table stakes to expect an entrepreneur to be hard working, driven, motivated, etc. The X factors we look for are vision & passion. Other things you learn is timing is so important – too early is bleeding edge, too late means you missed the land grab opportunity for customers and partnerships. We don’t mind being a little late so we can see what the incumbents are doing & tweak our offering but still be in time for the land grab.

What mistakes do you see less experienced investors making?

They haven’t seen enough business plans and business models to see which are the ones that have the best chance to become something.

What mistakes do you see Entrepreneurs making?

One of the common ones is they don’t have strong accounting and financial controls which is like driving a car without any of the instruments and panels which will ultimately lead to crashing. Or they micro-manage so you can’t grow the business and more importantly, that means you have people you can’t rely on or trust so what’s the point of having them on the team?

What’s the best piece of advice you ever received?

Use the value of Integrity to build a personal brand, just like you would a corporate brand. There are 2 types of integrity, internal and external. Internal is being true to yourself and your values – how do you act when no one is watching? If I tell my kids they shouldn’t litter if no one’s around or watching me, I shouldn’t litter! External integrity is saying what you mean and doing what you said you were going to do…even better is to UPOD (Underpromise Overdeliver) as opposed to OPUD (Overpromise and Underdeliver) which unfortunately can be human nature telling people what you think they want to hear to please them and then setting yourself up and them for disappointment. I’ve trademarked the acronyms and expression and if you use them correctly, you become this reliable, dependable person everyone wants on their team.

What advice would you give to those seeking funding?

See mentorship first, build those relationships up first so when the conversation eventually turns to fundraising, you’re more likely to get those cheques! Also, there’s money for the sake of money and there’s a spot on the cap table for that “dumb” passive money but generally you want to default to smart, value-add money all day long. And even more important is finding value-aligned money – with smart, value-add layered on top! Just like you would interview for hires for your company (and remember to “hire slowly, fire quickly”), you want to interview potential investors to see if you really want them on your cap table. Use that high bar of ‘would you invite that investor over to your house for dinner?’!

Who inspires you?

I love entrepreneurship, being part of a team, building, growing, creating wealth for all stakeholders. We like to focus on making other people money and by default, because I’m a large shareholder, I know I’ll do well as well. And using business to make as much money as I can so I can fund our philanthropic endeavours – I’m trying to make more so I can give away more!

What have you just learnt recently that blew you away?

I didn’t know anything about foreign exchange trading but our latest venture uses an AI algorithm to trade and generates 12 to 48% pa returns (as capital gains) depending upon 1 to 4X leverage, it’s been working for over 4 years.

What business book do you recommend the most?

“Be Great” by Peter Thomas.

Shameless plug for your business/organisation:

One of our main areas of focus is social impact investing – doing something good for the planet, people or hopefully both AND making money, we’re quite well-known & respected as one of the go to shops for entrepreneurs in this space. We’ve also been consistently making 20% per annum returns with our apartment buildings / multi-residential investments so it’s been fun growing our network of investors that are participating with us in these.go-to

How can people connect with you?

Through social media or email [email protected]

Social Media profiles?

LinkedIn: http://ca.linkedin.com/in/praveenvarshney/

Twitter: @praveenkv

Facebook: https://www.facebook.com/pvarshney

—

This article is part of the World Business Angel Forum media partnership with AsianEntrepreneur.org

If you would like more information about WBAF, please contact Callum Laing WBAF High Commissioner for Singapore. [email protected]