I was sitting in our weekly marketing team meeting when one of my colleagues touched upon some interesting statistics about the Asian American demographic. She mentioned the Asian American segment has grown by 60% between 2000 and 2013 to a total population of 19 million. Chinese and Indians account for the bulk of the Asian population at 23% and 19%, respectively. The third largest segment is the Filipino population comprising of 17% of the total. As relatively new immigrants, you’d think Asian Americans would earn less and be worth less than the median US household, but you’d be wrong.

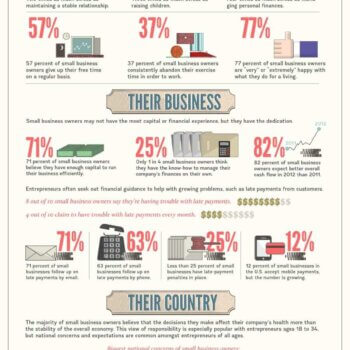

A 2010 Pew Research study pegged Asian households earning a median $66,000 a year vs. $49,800 for the average US household, a 32% difference. A 2013 Nielsen Research Report found that Asian American households have a median net worth of $89,300 compared to $68,800 for overall US households, a 30% difference. Meanwhile, roughly 49% of Asian Americans have Bachelor’s degrees vs. 28% of the general US population, a 75% difference.

With language and cultural headwinds, why is the average Asian American doing much better than the general US population? There’s no proof Asians are any smarter or harder working than other races. I quit math after junior year in high school because I hated math and didn’t see the practical use of taking Calculus in day-to-day life. I also like to lounge around as much as anyone.

I can’t speak for all Asian Americans, but I can provide some perspective as a Chinese American who grew up in four different Asian countries for 14 years before coming to America for high school and college. I was born in the Philippines and lived in Japan, Taiwan, and Malaysia. In college I studied abroad in China for six months. In the workplace, I took business trips to India, Thailand, Hong Kong, Japan, and Indonesia for 13 years in a row from 1999 – 2012. I’ve lived in the States for the past 23 years.

EXPERIENCES THAT SHAPED THE SOUL

When I was in the 4th grade in Taiwan, a Caucasian kid tripped me on the pitch and proceeded to yell racial slurs after I fell to the ground. He kept on barking obscenities until I swept his legs and stomped on his solar plexus in retaliation. He began to cry and we were both sent to “face the wall” for the entire afternoon recess period.

While we were squishing ants climbing on the brick just inches away from our faces, my assailant surprisingly turned to me and apologized. I was touched and apologized right back. We never fought or played dirty on the pitch again.

The soccer game was between “Chinese” vs. “Americans” while I was attending Taipei American School in the early 80s. I was placed on the Chinese team due to my ethnicity, instead of my nationality. I was too young to understand that I had just experienced my first racial conflict.

When I was a sophomore attending The College Of William & Mary in Williamsburg, Virginia, I had another very memorable racial encounter. My girlfriend (who was half-Asian and half-Caucasian) and I were eating some midnight waffles at Denny’s, of all places when a group of massive offensive linemen came barging in. They sat in the booth next to us and told us to “get the f*ck out you ch*nks” or else they’d beat the crap out of us.

By this time, I was already used to racial conflict as a 20 year old Asian American living in Virginia for the past seven years for high school and college. I always spoke up when there was an injustice, but this time I was outnumbered four-to-one. Although I mentally strategized on how to debilitate my oppressors, my girlfriend and I decided to leave as we were just about finished with our food anyway.

I felt ashamed I couldn’t do anything to fight for my girlfriend’s honor. Even now as a 37 year old, it irks me that I do not know their names every time I recall the incident because I want to give them a call ask them if they still have the hate. But what I do remember the week following the incident was that I made myself a promise to be financially independent as soon as possible so I would never have to take abuse from anybody again.

WHY ASIAN AMERICANS SAVE AND EARN SO MUCH

Building wealth starts with savings. There is no such thing as investing, buying a home,purchasing an annuity, or building alternative income streams without savings. Let me share with you six reasons why I think Asian Americans save and earn more than the median. Again, this is just one person’s point of view.

1) Asians are allergic to debt. Taking on debt to purchase a car, a piece of property, or stocks is a relatively new concept for many Asians. We’ve been taught the tenet, “If you can’t pay for something in cash, you can’t afford it.” This tenet runs counter to the heavy consumerism culture in America. If you go to any property developer in China (market is looking a little bubbly), it is common for 80%+ of the units to be purchased with cash compared to less than 40% in America. Debt is slavery. Cash is freedom. The US personal savings rate is roughly 4.8% according to the US Bureau Of Economic Analysis compared to 30%+ in places like China and India.

2) Lots of historical uncertainty and upheaval. When you have political instability and war, people tend to save more for their uncertain futures. Over the past 100 years or so, there have been a lot of tragedies in developing Asia. The Cultural Revolution and the Nanjing Massacre are two such tragedies in China. The ongoing heavy hand of the government may be another. The Taiwanese are perpetually afraid the Chinese will invade their country. The Japanese have been aggressively saving since their bubble collapsed in the 1980s due to deflation. The 1997 Asian Investment Crisis destroyed the wealth of millions of Thais, Indonesians, Malaysians, and South Koreans. Meanwhile, America has enjoyed a much more stable path of growth thanks to our Democratic system. Having better expectations of the future gives you more confidence in spending more money.

3) Few Asians in leadership positions. When there are hardly any Asian American politicians or CEOs of large corporations, it’s more difficult to visualize yourself in such positions as a kid. When there’s no examples to aspire to, there’s a tendency not to even bother. There are also very few Asian Americans on TV or in the movies, except for in type-cast roles. People tend to hire and promote other people who look like them and share similar backgrounds. It starts with race, then sex, then socioeconomic background. There’s no wonder why everybody tends to look the same. Take a look around the office and see if you can find the pods of similarities. It’s not like people nowadays are intentionally racist or sexist. People just want to work with people who they trust most. It’s harder to fully trust and understand someone who has a different background. (Related: The Solution To The Gender Wage Gap)

4) Family finances. It’s common to see post-college Asian adults still live at home with their parents. Why pay rent when you can live with the parents and save money for a downpayment, is a common way of thinking. There’s also a traditional aspect of living at home until one gets married, unlike US culture, which encourages independence as soon as possible. If you save $30,000 a year in rent for 8 years until age 30, you will likely be better off financially than average. I’ve discovered living in San Francisco for the past 13 years that parental financial help for their adult children is quite common. I personally could never imagine living back home with my parents after college.

5) Sports is not a realistic way out. Only a tiny percentage of the population ever become professional athletes. But the odds are even starker for Asian Americans in athletics, an area where meritocracy reigns supreme. There are hardly any Asian American basketball, football, or baseball players for example. And these three sports are a part of Americana where the best athletes are revered as heroes. Even for non-contact sports like tennis, there’s only been a handful of Asian athletes who have risen to the top of the ranks. Without the hope of athletics, the only hope left is in the field of academics and the arts.

6) Academics is the main level playing field. If there is one level playing field among all races, it’s in academics. If you study harder, you will likely get better grades. If you get better grades, you’ll likely get into a better university. If you get into a better university, you’ll likely get a better job and make more money. It doesn’t matter if you’re only 5 feet 1 inches tall, you’ve got the same opportunity as someone 6 feet 10 inches tall in academics. Even if you are poor, so long as you have a stable household you can still study as long a someone who is rich. There is nothing more important to the Asian American population than academics. Parents will do absolutely anything to help give their kids a chance to excel in school. From after class tutors every day to Sunday school, I’ve had it all, and so have many of my Asian American friends.

THE REALIZATION

Given Asian Americans account for only ~6% of the US population, many Asian Americans realize that nobody is going to save them – not the government, not their colleagues, not the NBA, not the majority. Even if every single Asian American was brilliant and physically intimidating, we’d still get crushed by everybody else as a minority.

The only people Asian Americans can count on are our immediate family and education. This is why you see such a concentration of Asian minority groups in various urban settings e.g. Chinatown, Koreatown, Japantown. It’s a similar concept to why schools of fish swim together in the great unknown ocean. This is why UC Berkeley’s undergraduate Asian population is roughly 40%, 7X the national Asian American population. Getting a good education and looking after family cannot be overemphasized.

My father explained to me after my fight on the pitch that this sort of racial conflict would keep on happening as I grew older. He was absolutely right. He taught me that in order to stop getting picked on I would have to fight back with my mind because there’s always going to be someone physically bigger and more intimidating than me. And even if I was a hulk with a black-belt in martial arts, a pip-squeak with a gun could end everything in a hurry. With his advice in mind, I started taking school much more seriously.

When I graduated from college and got my first job in NYC I decided to save as much money as I could. After the first year, I maxed out my 401k and saved 20% of my after-tax income. Yes, it sucked sharing a studio with my high school buddy as a 23 year old, but these are the types of sacrifices I had to make in order to save. Getting in at 5:30am and lasting until 7:30pm in order to eat the free cafeteria food wasn’t so bad.

After my third year of work, I was regularly saving 50% of my after-tax income because all I could think about when it was dark coming into work and dark leaving work was how wonderful financial independence would be. There were definitely many times when I was tempted to spend a small fortune partaking in NYC’s amazing nightlife. Even back then in the late 90s, it was difficult to not spend at least $100 going out. But for the most part I kept things frugal.

IN SEARCH FOR FINANCIAL FREEDOM

After saving 50%+ of my income for 13 years, I had accumulated enough to say goodbye to Corporate America. If I did nothing with my savings, mathematically speaking I would have at least 13 years of living expenses in the bank. But I actively diversified my savings into CDs, real estate, and dividend producing equities in order to produce passive income over the years. It’s important to eventually get money aggressively working for you so you can have more options.

Perhaps it’s easier saving money as a minority in America because there’s so much motivation to get ahead thanks to a tiny safety net. Going through racial conflict and seeing so much poverty in developing countries growing up really gave me a lot of perspective. If we are fortunate enough to live and work in America, most of us have it pretty good. But once we start seeing how the rest of the world lives, we’ll appreciate our situation even better.

In early 2012, I took it upon myself to get a handle on my own finances by signing up with Personal Capital’s Dashboard to track my net worth and manage my cash flow. Nobody is going to care more about my money than me, and I’m sure the same situation applies to you.

This article was written by Sam, the Financial Samurai at Personal Capital Blog. see more.