It won’t, however, be the saviour it’s being touted to be from the perspective of marketers and businesspeople who don’t understand it. Its real value lies in its ability to decentralise trust, taking that trust away from (centralised) organisations (mainly businesses and people that act as trusted third parties) and putting that trust into open, transparent computing algorithms, code and the community. This has massively disruptive potential for several different industries that have historically relied heavily on centralised networks of trust, especially financial services.

To understand more precisely why the blockchain has disruptive potential, one needs to understand, firstly, what decentralised systems are in general, and, secondly, why the blockchain exists at all. This will also help in understanding why one should not blindly trust the hype around it.

Decentralisation

Take a look at the following three pictures to understand the high-level differences between centralised, decentralised and distributed systems. In the diagrams, black dots represent “client” or “peer” nodes in the network (such as your mobile phone or laptop, or perhaps an individual customer of a bank), and blue dots represent trusted “server” nodes (such as the servers belonging to Facebook, your bank, or your e-mail service).

Facebook, Google, banks, most modern businesses

Bitcoin/Blockchain, E-mail, YaCy

BitTorrent

I purposefully represented the blockchain as a decentralised system as opposed to a distributed one because not all nodes in the network are full nodes holding the whole blockchain in its entirety. It is possible to make use of the blockchain without storing all historical transactions, but if you don’t store the entire transaction history, you’re implicitly trusting all of the other full nodes who do.

What is the Blockchain?

For the non-technical audience: the blockchain, in the way it’s used by Bitcoin, is simply a way of representing financial ledger transactions in a sequential way (the order of all users’ transactions is vitally important to the integrity of any transactional system). So why all the fuss? Watch the following video – it does a good job of explaining the real value and significance of Bitcoin and the blockchain, and how it works, at a very high level. After that, I’ll dig into some of the differences between traditional, centralised accounting practices, as compared to decentralised, blockchain-based accounting.

Traditional accounting

When using traditional financial accounting software systems (e.g. Sage One), some of the underlying assumptions are that:

- You can trust the person (or system) capturing financial transactions that happen in the real world.

- You can trust your software to store them in the correct order.

- You can trust your people and software to only store a single instance of a particular transaction (no double-spending allowed).

- You can trust the people and software to not go back and tweak or modify those transactions’ details.

Companies implement strict, usually hierarchical, controls and governance around who can actually manipulate the data stored by their accounting software, and are audited regularly to ensure there’s no foul play. The servers storing the financial data are usually centralised, so that there’s a single source of truth that all connected clients can trust to give them accurate information.

So how would it work if we decentralised our trust in the financial transaction history?

Decentralised, blockchain-based accounting

There is no single source of truth in the blockchain, which was a novel invention by Satoshi Nakamoto in trying to solve the problem of ensuring that ledger transactions are correctly ordered and cryptographically verified in a decentralised system. Here, users do not trust each other, but rather put their trust into open, transparent, cryptographic algorithms and protocols, and the strength of the network.

Comparing decentralised accounting with the traditional accounting trust points mentioned earlier:

- You cannot trust anyone submitting a transaction to the network, but you can trust in the algorithms used by the network to check that your transaction is valid.

- You can trust the blockchain to store transactions in the correct sequence. Sometimes, it does happen that the blockchain gets forked due to a disagreement between the peers as to which block of transactions should be next in the sequence. This is automatically resolved by the network.

- You can trust the blockchain to ensure no double-spending.

- You can trust the cryptographic protocols in the network to ensure that nobody modifies historical transactions. This would result in corruption of the blockchain, and the peers would reject any such modifications.

Disruptive Potential

Now we get to the so what? part of the discussion: what, then, makes the blockchain so “disruptive”?

Goodbye banks?

Since it isn’t just your bank that keeps a copy of the ledger, and you can keep a copy of the ledger yourself too (where you and the rest of the community are held accountable to each other through cryptographic algorithms), why do you need a bank to facilitate transactions for you? Beyond getting credit from the bank, what more does the bank really do for you than act as a trusted third party between you and the other person with whom you’re doing business?

This sort of disruptive potential applies to absolutely any real-world situation where there’s a need for a trusted third party whose sole purpose is to facilitate and reliably track transactions. If it’s in the interest of a community to keep track of something in a trustworthy way, a decentralised blockchain can do just as well today as a trusted third party’s software systems.

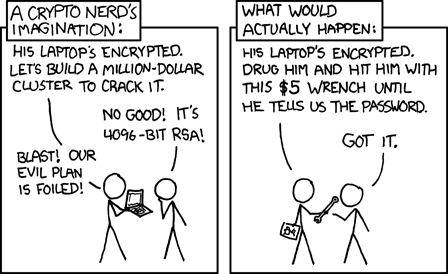

Unfortunately, the blockchain is also a relatively new technology and is still being battle-tested by the community to ensure that it really is secure. Information security is far more than just cryptography, as per the following XKCD comic.

Applications outside of finance#

Being a decentralised transaction tracking system, the kind of transaction that gets tracked by the blockchain is totally up to the developers building the application layer of software on top of this transaction tracking system. Bitcoin, by design, is a financial transaction tracking system built on top of the blockchain.

Several application areas for the blockchain outside of finance come to my mind:

- Accommodation booking systems, especially Airbnb-style accommodation bookings.

- Parcel tracking systems, especially where multiple different courier services are employed to deliver a parcel.

- Government accountability systems, where the general public can reliably track whether their government is delivering on their promises (whether this be financially or otherwise).

- Community-oriented agricultural produce tracking systems, which could allow transparent tracking and reporting of local agricultural produce for communities.

And there are potentially loads more.

Don’t trust the (irresponsible) marketers

Therefore, the blockchain is potentially disruptive. But it won’t necessarily benefit all businesses. Disruption might just mean that your business is the one being disrupted, meaning that it might just put you out of business. (If, of course, you’re in the business of acting as a trusted third party).

Who really benefits from the blockchain?

From what I can see, your business only really stands to benefit from the blockchain if you:

- rely heavily on one or more trusted third parties,

- provide a good/service to the broader community,

- would save time/money/etc. if your trusted third parties were decentralised and entrusted to the community, and

- the broader community comprises, at least partially, of people who are technologically savvy and invested enough in your good/service to want to be part of the community to whom your data is entrusted.

Don’t trust the banks’ “love” of blockchain

Apparently, many international banks are embracing the blockchain. I would personally be very skeptical of this sort of move on their part, because it is the very nature of the financial institution that currently stands to be disrupted by blockchain-like technologies.

For example, Bank of America is apparently “going big” on Bitcoin and the blockchain. By filing patents? All this does is provide them with ammo to potentially sue people who infringe those patents, potentially hindering efforts to decentralise the financial system. From my perspective, this is a purely self-preservation-oriented move on their part.

I also call bullshit on every bank who claims they’ll benefit by implementing a blockchain internally within the bank for tracking transactions. In computer programming, this is pretty much what we call a CQRS architectural model, and the banks should be using that kind of model anyways.

The whole point of the blockchain is to decentralise its storage and entrust the transaction validation and history to the community. What good is it if all of the nodes are behind the bank’s firewalls? How is that any different, from the perspective of a bank customer, to the situation as it is today, where the customer’s trust still effectively has to be centralised within the bank?

Conclusion

The blockchain is a technology aimed at decentralising trust. This has the potential to disrupt some industries that presently rely on trusted third parties. Those who stand to benefit the most are people who currently rely on trusted third parties, whereas those who stand to lose the most are those who are trusted third parties in facilitating transactions between other people.

Finally, don’t trust irresponsible marketers when they tell you that the blockchain is the solution to all your problems (it only solves a pretty niche sort of problem, actually), and for goodness’ sake don’t trust the banks when they say they’re in full support of the blockchain. These two groups of people are the most likely candidates to, inadvertently or on purpose, strangle it to death while nobody’s paying attention.

____________________________________________________________________

About the Author

This article was written by Thane Thomson, who is currently working for DStv Digital Media in research and development