Ching Wei Lee(Ching) is the group chief executive officer and co-founder of iMoney.

Prior to iMoney and since a young age, Ching has always had a strong interest in business and entrepreneurship. At university, Ching completed a bachelor of commerce, majoring in finance and accounting. Finance and particularly investment has always fascinated Ching, who ended up working as a financial advisor as his first job out of university, where he advised high net worth clients on personal financing. Ching moved on to investment consulting a year later offering investment advice to clients with large pension funds ranging from $500 million to $30 billion. It was at this time, where Ching learned the most in the finance. It was also during this time, he completed two prestigious professional qualifications, the CFA and CAIA charterholder.

Ching’s first venture took place, whilst he was still in University. 2 months into living in Melbourne city, Ching found “parking” to be an issue most working class adults that drive into the city for work pay a lot of money in parking. So, being opportunistic, Ching started a “parking rental” service. Essentially, renting from students at a low price, and re-renting out to working adults at a higher price.

Ching would eventually come to co-found iMoney, a highly successful website used by many Malaysians today. Ching is here today with the Asian Entrepreneur to tell us more about iMoney and the story behind it.

For those who don’t know, what exactly is iMoney and how is it relevant?

iMoney is a financial comparison website that exists for the sole purpose of helping consumers to make quick, well-informed decisions for ALL banking products and services currently in the market. It was conceived based on a very simple notion – that no one should ever need to fall victim to making a choice they’d regret when it comes to banking products – we’ve created a dedicated multi-function online platform containing up-to-date, unbiased information for the entire repertoire of banking products and services in Malaysia .

This is done via a meticulous manual process that involves, systematically collating and analysing the latest data from over 200 credit cards, 300 savings accounts, 500 loan packages and thousands of investment products in the market; and breaking down the complicated banking rules and regulations and dissecting the perplexing financial terms and jargons that most people simply do not understand.

Simply put, what we offer is a gateway to help people save time and money by being able to instantaneously make the best decisions when choosing from the enormous range of financial products available in Malaysia. Decisions that will benefit the consumers and not just the banks. Decisions that no one will ever need to regret a few years down the road.

How did you come to start iMoney?

My interest in tech & web based startup has always been there. I’m an avid user of technology and web based applications and even created a few web-businesses of my own, and in my last couple of years, I followed quite closely the startup scenes in the US. That was the time when huge tech based companies, for example, Evernote, Dropbox, started becoming really popular.

When I returned to Malaysia in the beginning of 2012, it was clear that I didn’t want to re-enter the corporate world, I’ve lost all interest by then. Being a returning resident, I had to do the things that many people take for granted, getting a bank account, a credit card. That was when I found out how difficult and complicated the entire research, comparison and application process was in Malaysia.

Coming from a more advanced country like Australia, I was used to web-based solutions for simple things like opening a bank account and applying for a credit card. There were many websites in Australia that you could do this with. This was really the spark of the idea behind iMoney.

It was during that initial weeks that I caught up with my high school senior and serial entrepreneur, Khailee Ng. Khailee introduced me to our third co-founder, Bruno, who then still worked at a bank. After a couple of meet ups, and some desktop research, it was clear Malaysia could use an independent, consumer-centric financial comparison website. We saw how big a problem Malaysians are facing in comparing and identifying the best financial products for them. iMoney was born, officially in June 2012.

Did the site pick up fast in Malaysia?

The reception was great actually. I think Malaysians generally find having a site like iMoney a great addition to their daily lives! Until iMoney arrived, comparing and applying for financial products was an extremely painful process.

What would say is your greatest challenge with iMoney?

Some of my greatest challenges were convincing our partners that iMoney will be a very relevant and significant part of people’s lives. In the early days while we were still very small, nobody took what we said seriously. We always bounced back, quickly, from rejections and failures, and kept on working hard thankfully, it’s getting easier now!

What’s the goal with iMoney?

We are already Malaysia’s biggest financial portal, and our ambition is to become the top financial comparison site in the whole of South East Asia! We are on track to generate more than US$1 billion in business to banks and insurance companies this year.

What are some important lessons you’ve learnt working on iMoney?

At one point, I was wearing multiple hats, and taking on too many responsibilities as I was not willing to invest in resources.The business ended up suffering due to the lack of good and fast execution in multiple areas, not surprisingly, since there is only so much a person can do. With guidance and mentorship, I started building a team, delegating and trusting more, and a lot of what we have achieved to date is largely down to this — the amazing people around me who are much better at what they do than I would ever be. I think the lesson here is, learn to delegate, and invest in building something sustainable.

Tell us about some principles that guide you as a person.

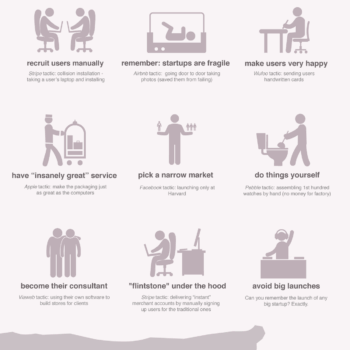

I’m an advocate of the lean startup movement, that is, launching quick and learning fast, failing often and failing early.I’ve always had the view that you can never create a perfect product, and it’s much better releasing ideas, products early and receiving feedback fast, instead of spending too much time creating a “perfect” product, that may or may not be “perfect” in the eyes of users.

Any parting words of wisdom for our readers?

Absolutely!Constant learning and personal growth, I encourage self-improvement and becoming a better person today than you are yesterday. I’ve seen how much value an investment in yourself can bring, it’s why at iMoney, we make available a personal growth benefit to all staff, irrespective of position and job role. Have a greater purpose in life than money, yes, if iMoney turns into a big success, we’d all make a lot of money. But that was never the primary reason I started iMoney. I believe if money is your primary motivation, you’d always build a business that optimises for money only, and few businesses like that succeed over the long term. Enjoy what you do, always. Life is really short. If you aren’t doing something you enjoy or love every day, you’re really not doing yourself justice.

Connect with Ching Wei Lee and iMoney today:

Linkedin: http://my.linkedin.com/pub/ching-wei-lee/37/305/b33

Website: http://www.imoney.my/

Email: [email protected]

Facebook: http://www.facebook.com/IMoney.my?fref=ts