So your ambition in life is to be a millionaire before you turn 30! Fabulous.

It’s a great ambition. It is not difficult, but it is not that easy either, as you might very well know. There are many routes that people take to become a millionaire – betting on horses, gambling, investing in real estate, winning a lottery, becoming an entrepreneur. Some rely on luck while some work hard for it. Luck is fleeting, rare, but hard work pays, hundred percent. So, how do you become a millionaire? Here’s how:

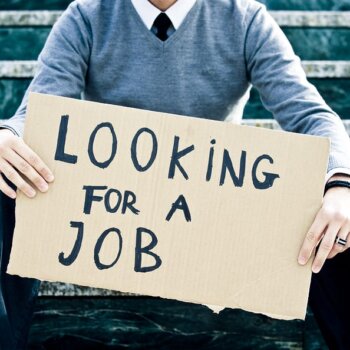

Earnings from your job

Obviously you need a steady stream of income to build your million. The more money you earn, the quicker the journey to your milestone will be. But that doesn’t mean you can get there on a Government salary. It has to be substantial.

Know your limits

You have to know your limits. You obviously cannot spend more than you make. That’s a financial suicide. If you can’t afford to buy that Sedan, don’t. Buy a hatch. If you can’t afford to eat at fancy restaurants, start cooking at home. If traveling by your vehicle is expensive, switch to public transport. You don’t have to turn into a pauper, just practice smart living. Quit getting magazines you don’t read; get rid of the internet connection if you don’t use it that often. You use it at work anyway. Switch to prepaid connection if you’re on a post-paid mobile plan. Get rid of that credit card so you never get tempted into buying stuff on an impulse. When you shop, shop in bulk. Quit buying the newest gadgets. Basically, live a lifestyle that you can afford.

Save Money

Just making money won’t suffice. You need a savings plan. Don’t leave it for too late. The longer you save the more money you will end up with. Don’t think of saving after you’ve paid all your bills. Set aside a percentage of your salary every week or every month and put that money into a separate account and refrain from getting an ATM card. That way you will think twice before withdrawing money.

Make good investments

Make sound investment decisions. Listen to news, read the papers, talk to knowledgeable people and seek their advice on investments. You can even seek services of an investment agency. Invest in a diversified portfolio and be consistent. Maybe a systematic investment plan or SIP. You can even look at mutual funds, stocks, shares etc. Make sure you have the ability to take risks because you will win some and you will lose some. Buy land or gold or flats if you have that kind of cash. It will appreciate over a period of time and you can sell it off later to make a good profit.

Start your own business

You can turn into an entrepreneur even, investing your money into growing your business. If the idea is good and you’re a good manager, you will be able to make quite a bit of money. Always keep looking at avenues to increase your income.

Your hobby could make you rich

If you have a hobby like stamp collection or comic books collection (in mint condition), antiques or original paintings, or any collector’s items. They could fetch a great amount if you decide to auction them.

Get married

By marrying a working woman, you not only double your salary but also your savings.

Becoming a millionaire is not easy, or else all of us would be one. It is tough. It needs planning and perseverance. If you’re willing to put in hard work over a period of time, you will be rewarded.