Key Takeaway:

China’s national champions for semiconductor design and manufacturing, HiSilicon and Semiconductor Manufacturing International Corporation (SMIC), are making waves in Washington. Huawei’s launch of the Huawei Mate 60 smartphone in August 2023 showed that Chinese self-sufficiency in HiSilicon’s semiconductor design and SMIC’s manufacturing capabilities were catching up at an alarming pace. The US has long maintained its clear position as the frontrunner in chip design, but now faces formidable competition from China, whose technological advance carries profound economic, geopolitical, and security implications. The US has sought to safeguard its technological supremacy and independence by bolstering its own manufacturing ability, imposing stringent export controls, and limiting talent flows to the Chinese semiconductor industry. The “chip war” is about economic and security dominance, with Beijing’s ascent to the technological frontier posing profound security implications.

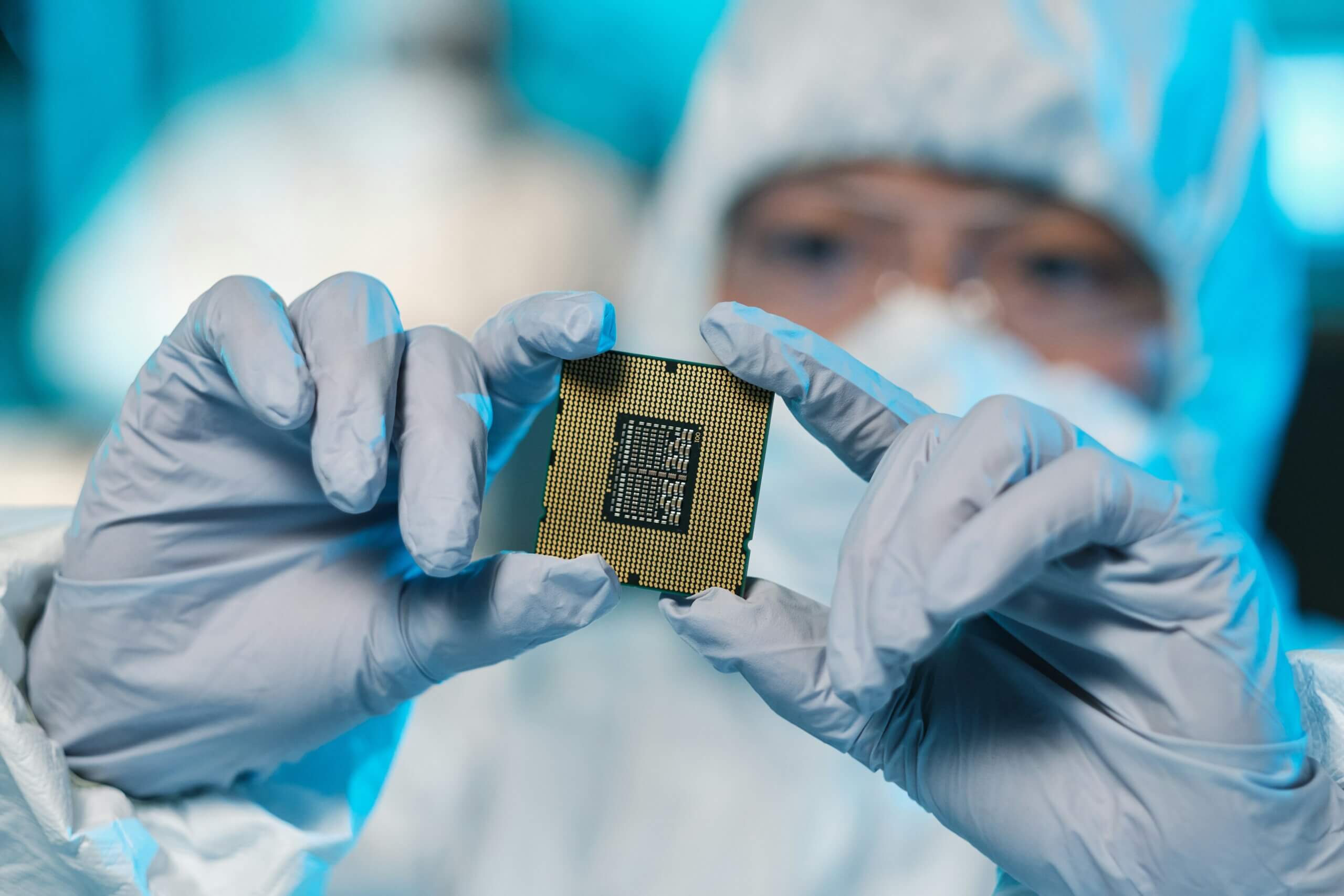

China’s national champions for computer chip – or semiconductor – design and manufacturing, HiSilicon and Semiconductor Manufacturing International Corporation (SMIC), are making waves in Washington.

SMIC was long considered a laggard. Despite being the recipient of billions of dollars from the Chinese government since its founding in 2000, it remained far from the technological frontier. But that perception — and the self-assurance it gave the US — is changing.

In August 2023, Huawei launched its high-end Huawei Mate 60 smartphone. According to the Center for Strategic and International Studies (an American think tank based in Washington DC), the launch “surprised the US” as the chip powering it showed that Chinese self-sufficiency in HiSilicon’s semiconductor design and SMIC’s manufacturing capabilities were catching up at an alarming pace.

More recent news that Huawei and SMIC are scheming to mass-produce so-called 5-nanometre processor chips in new Shanghai production facilities has only stoked further fears about leaps in their next-generation prowess. These chips remain a generation behind the current cutting-edge ones, but they show that China’s move to create more advanced chips is well on track, despite US export controls.

The US has long managed to maintain its clear position as the frontrunner in chip design, and has ensured it was close allies who were supplying the manufacturing of cutting-edge chips. But now it faces formidable competition from China, who’s technological advance carries profound economic, geopolitical and security implications.

Semiconductors are a big business

For decades, chipmakers have sought to make ever more compact products. Smaller transistors result in lower energy consumption and faster processing speeds, so massively improve the performance of a microchip.

Moore’s Law — the expectation that the number of transistors on a microchip doubles every two years — has remained valid in chips designed in the Netherlands and the US, and manufactured in Korea and Taiwan. Chinese technology has therefore remained years behind. While the world’s frontier has moved to 3-nanometre chips, Huawei’s homemade chip is at 7 nanometres.

Maintaining this distance has been important for economic and security reasons. Semiconductors are the backbone of the modern economy. They are critical to telecommunications, defence and artificial intelligence.

The US push for “made in the USA” semiconductors has to do with this systemic importance. Chip shortages wreak havoc on global production since they power so many of the products that define contemporary life.

Today’s military prowess even directly relies on chips. In fact, according to the Center for Strategic and International Studies, “all major US defence systems and platforms rely on semiconductors.”

The prospect of relying on Chinese-made chips — and the backdoors, Trojan horses and control over supply that would pose — are unacceptable to Washington and its allies.

Stifling China’s chip industry

Since the 1980s, the US has helped establish and maintain a distribution of chip manufacturing that is dominated by South Korea and Taiwan. But the US has recently sought to safeguard its technological supremacy and independence by bolstering its own manufacturing ability.

Through large-scale industrial policy, billions of dollars are being poured into US chip manufacturing facilities, including a multi-billion dollar plant in Arizona.

The second major tack is exclusion. The Committee on Foreign Investment in the United States has subjected numerous investment and acquisition deals to review, ultimately even blocking some in the name of US national security. This includes the high-profile case of Broadcom’s attempt to buy Qualcomm in 2018 due to its China links.

In 2023, the US government issued an executive order inhibiting the export of advanced semiconductor manufacturing equipment and technologies to China. By imposing stringent export controls, the US aims to impede China’s access to critical components.

The hypothesis has been that HiSilicon and SMIC would continue to stumble as they attempt self-sufficiency at the frontier. The US government has called on its friends to adopt a unified stance around excluding chip exports to China. Notably, ASML, a leading Dutch designer, has halted shipments of its hi-tech chips to China on account of US policy.

Washington has also limited talent flows to the Chinese semiconductor industry. The regulations to limit the movements of talent are motivated by the observation that even “godfathers” of semiconductor manufacturing in Japan, Korea and Taiwan went on to work for Chinese chipmakers — taking their know-how and connections with them.

This, and the recurring headlines about the need for more semiconductor talent in the US, has fuelled the clampdown on the outflow of American talent.

Finally, the US government has explicitly targeted China’s national champion firms: Huawei and SMIC. It banned the sale and import of equipment from Huawei in 2019 and has imposed sanctions on SMIC since 2020.

What’s at stake?

The “chip war” is about economic and security dominance. Beijing’s ascent to the technological frontier would mean an economic boom for China and bust for the US. And it would have profound security implications.

Economically, China’s emergence as a major semiconductor player could disrupt existing supply chains, reshape the division of labour and distribution of human capital in the global electronics industry. From a security perspective, China’s rise poses a heightened risk of vulnerabilities in Chinese-made chips being exploited to compromise critical infrastructure or conduct cyber espionage.

Chinese self-sufficiency in semiconductor design and manufacturing would also undermine Taiwan’s “silicon shield”. Taiwan’s status as the leading manufacturerof semiconductors has so far deterred China from using force to attack the island.

China is advancing its semiconductor capabilities. The economic, geopolitical and security implications will be profound and far-reaching. Given the stakes that both superpowers face, what we can be sure about is that Washington will not easily acquiesce, nor will Beijing give up.