Malaysian, Wallace Lingard is the co-founder of Volition Ventures, a private company that invests and facilitates the private investments of ventures and start-ups found in universities across the world. Asia is a prominent region where Volition Ventures conducts its operations and Wallace has played an active and personal role in sourcing investment opportunities there. A notable entrepreneur who sold his first business in 2008 for AUD $100,000. He started up Volition Ventures after seeing great opportunities for private investments and funding in the collegiate scenes throughout the world.

Today, Wallace has agreed to speak to us about Volition Ventures and share with us his experiences in entrepreneurship and business development.

So what is Volition Ventures all about?

At Volition Ventures, we specialize in funding and investing in start-ups and ventures. We do this by directly investing in these ventures or facilitating the investment of these ventures by other private investors. We are able to do the latter because we maintain a private network of private investors. So, the kind of ventures and start-ups we are interested in are generally those found in universities. Our company operates in 3 major regions at the moment, Asia, Australia and the United Kingdom. Everything has been pretty exciting so far. We work with entrepreneurs and small businesses and that has always been fun.

Why do you guys focus on ventures found in universities?

Well, why not? Unlike what many people think, universities are actually prime grounds for entrepreneurial activities. You’ll tend to find that many people are working on great ideas and really fresh businesses. The major problem for them is that these people normally would usually need funding like most start-ups. So there is a real need here for private investments. What you will also find is that there is also this issue that pervades university start-ups. They do not know how to approach funding. So there is a real need for a step in there. What we do is, we step in, and work on providing accessible funding to these entrepreneurs and ventures.

How did Volition Ventures come about?

My partners and I have been independent common equity investors for awhile. After accumulating a certain amount of money from stock investments, in 2011 we decided it was time to diversify our investments. This was largely due to the economic climate at the time, it was Euro-crisis which made stock markets and investments volatile and uncertain. So one thing we really began to consider was putting our investments elsewhere in more stable environments. We decided to invest in business and ventures. At that time we were aware of several start-ups in Universities that needed funding through friends. Initially, it was a dietary supplement business, followed by a clothing line which we worked on. Eventually, we began to hear more about ventures from other people from other universities. This was when we realized that there was really a real need for investments there. As we expressed our interests in venture investments, we were contacted by even more people. Obviously, we were not capable of investing in all of these ventures so I began to contact other potential investors who may be interested in these opportunities and that was when things began to really pick up at Volition Ventures.

Did you face any problems building trust with other private investors?

Not really to be honest. We are quite open with how we do things at Volition Ventures. I think open communication was something we emphasized throughout since the incorporation of our company, so at no point did private investors feel any distrust towards us. The other important thing is we aren’t a fund per se, as such we don’t directly deal with or hold on trust the money of others. So there was never a real concern of whether one should trust us or not.

What about building trust with entrepreneurs?

Again there was never a problem here. This comes down to what I’ve just said about being open. We are quite open in how we deal with entrepreneurs. We are very straightforward in how we approach and communicate with them. At no point was there an issue here. Though, I will say that a lot of entrepreneurs in universities, tend to have a lot of questions about funding and investments as they apply to their ventures. So I think that being patient is a very important to when dealing with these individuals. We have been quite patient and I think that has certainly helped in building trust with them.

What are the major challenges you faced in starting Volition Ventures?

Marketing. Marketing was the major challenge. Making ourselves known to entrepreneurs in universities was the major challenge. It was not so much a challenge making ourselves known to private investors. This is because many private investors’ associations and networks exist and its so easy to find them online, so contacting them is not a problem. The internet has really centralized them and made its relatively easy to find investors. The same cannot be said about entrepreneurs, especially entrepreneurs in universities. The other challenge was finding the right committed team. I think its very important to have staff members in ventures that are committed to the cause, especially when you are a start-up.

How did you overcome these challenges?

Because what we were focusing on was the university scene, so we had to overcome the challenge of marketing ourselves in very specific ways. For us, it was building up our presence there and we did this via representatives at different universities. We also focused on connecting ourselves with idea incubator groups and business guilds at universities. We also utilized Facebook in building our recognition base. We did this by creating a selective news source for people who liked our page. All in all, it has been quite successful so far, so it is no longer a real challenge for us now. In terms of finding the right team, I think for us naturally those who were not committed did not stay on and we were able to find committed replacements, so the problem really fixed itself.

What are some interesting ventures you’ve encountered?

There are so many that I’ve encountered in my work with Volitions that I find interesting. The range is really diverse. We’ve worked with commodity brokerage ventures, clothing lines, consumer goods, food and beverage ventures to name a few. I think if I had to pick one it would be social media. They really do hold limitless possibilities to reconstitute our social experience. We hear a lot from social media entrepreneurs and the ideas that some of them have is truly innovative. In fact, we are currently invested in two such ventures that are in the process of being launched.

What are some important lessons that you’ve learnt when pursuing your venture?

We’ve made mistakes and we’ve learnt many things. If I were to give a brief summary, I’d say, be committed with your venture and also be resilient in not giving up. There were many times throughout the beginning phases of Volition Ventures where many of us felt like giving up. A lot of us have professional careers and obligations aside from the venture. So at times it was very hard to work on it, but we kept at it and even though there were times when we felt like we were not getting the results we wanted, we kept at it. We have now reached where we wanted to be and this was only possible because of our resilience and commitment.

What is one word of wisdom you would share with other entrepreneurs out there?

Don’t give up. Its really as simple as that. I have been an entrepreneur for a few years now, some ventures I’ve worked on have failed. Others have succeeded beyond my expectations. The difference I think was in how committed I was to any venture. There are no failures, only different results. As long as you keep trying to improve, there is really no room for ultimate failure.

In your opinion where does the future lie?

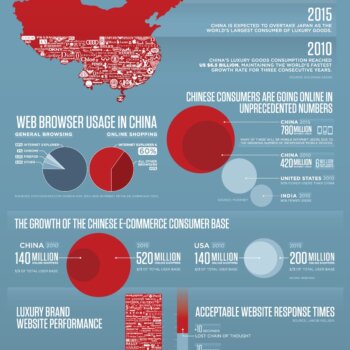

I think the future lies in social media. As I have pointed out a few minutes ago, social media has the capacity to redefine our very own personal experiences. So I think if there is anything I am excited about, it is social media and the future developments there.

Connect with Wallace and Volition Ventures today:

Facebook: http://www.facebook.com/VolitionVenturesLimited

Website: http://www.volitionventures.co.uk/