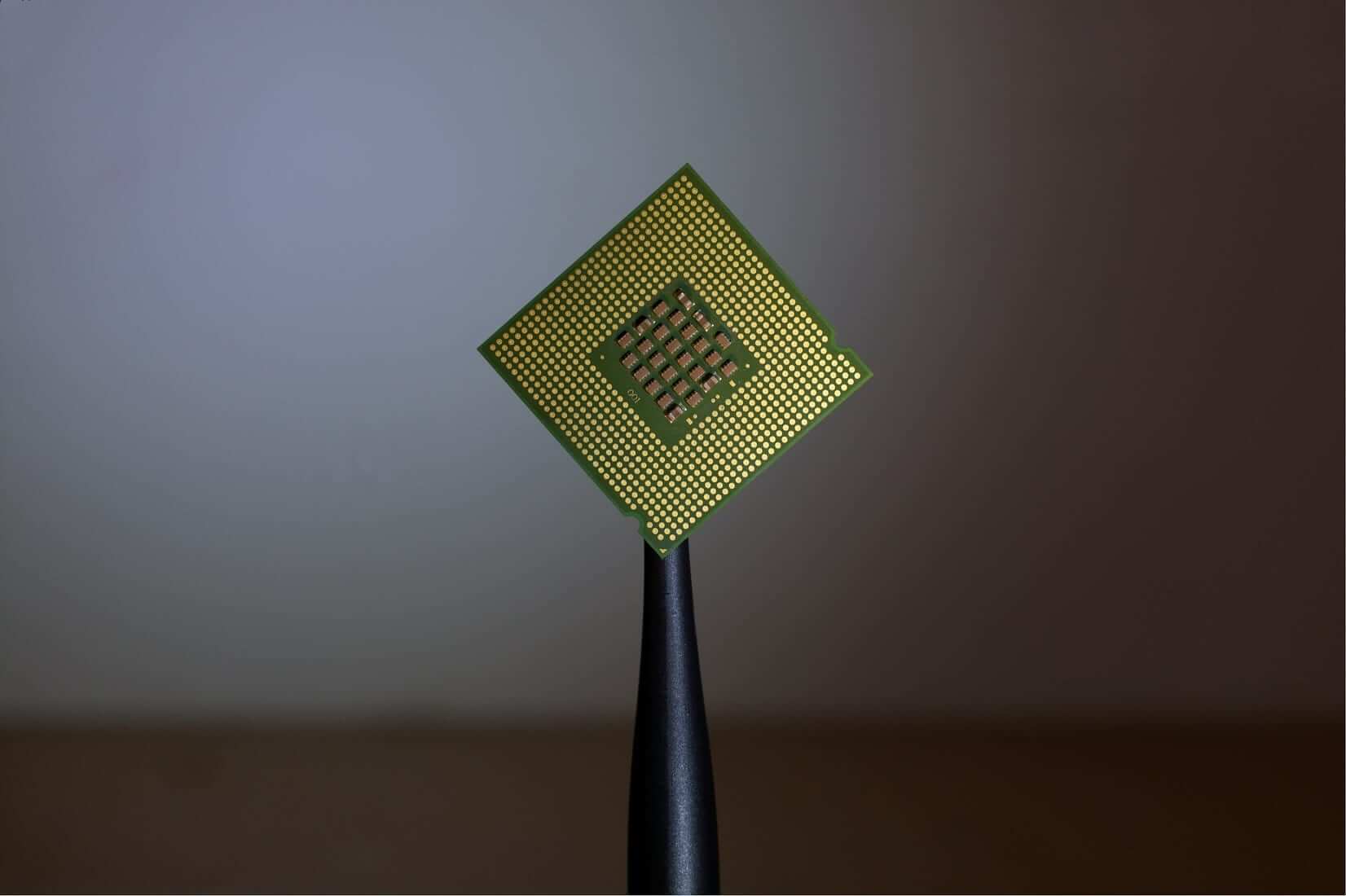

Intel has announced a delay of more than a year in its 7nm chip manufacturing process, which gives an idea of the reasons why Apple recently announced it was abandoning the US company’s chips and would make its own and use ARM architecture instead.

Intel’s problems are not new: this is not the first time the company has announced delays. This time, however, is more serious, considering the importance of the 7nm manufacturing process and that competitors such as AMD have been offering the market the same chips, which consistently improve on the performance of Intel’s, leading to a sharp drop in share value. For Apple, Intel had clearly become a bad bet, and going for other types of architecture over which, in addition, it could have higher levels of control made complete sense.

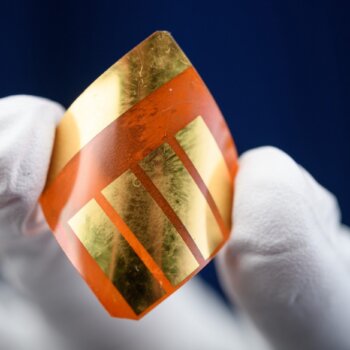

However, the microchip market is is a complex one right now: Japanese conglomerate Softbank, which acquired ARM in July 2016 for $32 billion, says that in the midst of a strong disinvestment to try to amortize the enormous losses of its technology investment fund it intends to look for a buyer for the microprocessor architecture design company.

Who would be interested in acquiring ARM, a company that in 2016 had a turnover of around $1.5 billion in licensing its designs and technology to device manufacturers, who pay a small amount for each unit sold? Softbank paid 21 times its turnover, and has now offered it to Apple, for which it is obviously strategic. But Apple has said no: it’s not in the business of licensing technologies and, moreover, trying to do so, considering that many of its hypothetical clients would be many of its competitors, could put it in a very difficult situation given that the antitrust authorities on both sides of the oceannow have it in their sights.

All indications are that for Apple, which is working hard to advance the microchip industry and has a strong mutually advantageous partnership with Taiwan’s TSMC, one of the two leading microchip manufacturers, the best thing that could happen to ARM is for it to stay put: Softbank is a relatively “neutral” company in the technology market, which has not interfered with it, and has merely provided it with the resources it needed to operate. The only problem, of course, is that Softbank needs money, and ARM, which was once very expensive, may be worth a lot. But what if it were a competitor of Apple that could, for example, redirect its strategy or priorities in ways that were less interesting to Cupertino, or that could, for example, raise the price of its designs? Is Nvidia a prospective buyer? What if it were acquired by Google? Or Qualcomm, with which Apple has already had problems?

How did a company that doesn’t manufacture anything tangible, that does not make microchips, but limits itself to designing its architectures, achieve such a central and complex role in the technology ecosystem? Looking to the future, we are also talking about a company with enormous potential: the internet of things means that everything around us will have a microchip in it, which will multiply both its importance and the company’s turnover, based on “many little bits” of all kinds of connected objects.

From a strategic viewpoint, the microchip sector is a fascinating environment worth taking the time to understanding. Is there a better candidate out there to increase the value of a company like ARM? And how important today are not just the ubiquitous microchips, but the companies that design their architecture?

About the Author

This article was written by Enrique Dans, professor of Innovation at IE Business School and blogger at enriquedans.com.