Pitching. It is not as simple as getting on stage and sell your company. A lot is done preparing behind the scenes. Numbers, statistics, that ubiquitous powerpoint deck. SaaS companies have it the worst. They need to have the typical MRR and burn as well as LTV, CAC and churn.

“So overwhelming!” An entrepreneur friend of mine lamented. I agree. As an individual working at NewGen Capital, I ask for a lot of things. I have a document called the Due Diligence.docx to fill and I will not accept [Blank] for any of the 10 sections.

It used to be that the Due Diligence process was somewhat of a secret. Entrepreneurs had ideas what were necessary but not in great detail. Fast forward to today, everyone knows the checklist. There are many online sources that give an idea of what information Venture Capital workers look for. (Here is a sample)

However, the checklist created a new problem: Information Diarrhoea.

This is very observable at pitch events. With 3 minutes to pitch, some founders rushed to cover all 10 sections of the DD process. It is as though founders forgot about being succinct and sell 1 main point.

So what is the most important point to sell? A lot of entrepreneurs I spoke with said ‘Sell my company.’ A good answer but a tad too generic. A better question to ask for a universal answer is; What are VC firms hoping to achieve with investing? By knowing what their goals are and aligning with them, entrepreneurs have a better chance of raising successfully.

The goal of a VC firm can be structured as a standard optimisation problem:

Maximise: Y (Returns)= X*[Factors(including Growth and Others)]

Contraints: Time

Output Y [Returns ($)]

All Venture funds have one end goal: To return the principal amount of the fund and more. Funds differ on the percentage they seek to return to their own investors (Called Limited Partners), but a common amount floating around is about 20% per year. This is a 20% compound return every year for the duration of the fund’s existence (most are around for 10 years). Applying this metric to NEA’s 15th fund that is about USD $3 Billion, assuming a 10-year fund period, NEA needs to grow that fund to USD $15.5 Billion. By Year 10. That is about 5 times the original fund size. Where will NEA get those USD $12.5 Billion? By investing in startups.

Factor X [StartUp]

Investing in Startups is the VC way of generating returns for their investors. They look and invest in startups with the greatest potential to help the fund return 5x the original fund. Historical values have shown that the 80–20 ruleholds true for VC portfolios; about 20% of their portfolio will end up bringing in the dough. The rest just don’t. The reasons why startups fail vary, but it may be bad timing, founders feud or just freak accidents.

Yet the bottom line is this; all investments made by Venture Capitals carry the implicit assumption that they will not fail. All investments, at the point of investing, must be deemed to have the potential to return the fund and more. At least 5x more. What determines if Startup X has the X factor depends on a multitude of factors, but one may play a more critical role.

Factors [Growth]

That is growth. Growth refers to the increase in revenue numbers for a company. It is a strong indicator on whether a startup can return the fund and more. This is because growth is highly correlated with the value of a company, unlike profitability. This article by Tomasz Tunguz explains why growth triumphs profitability in the public markets.

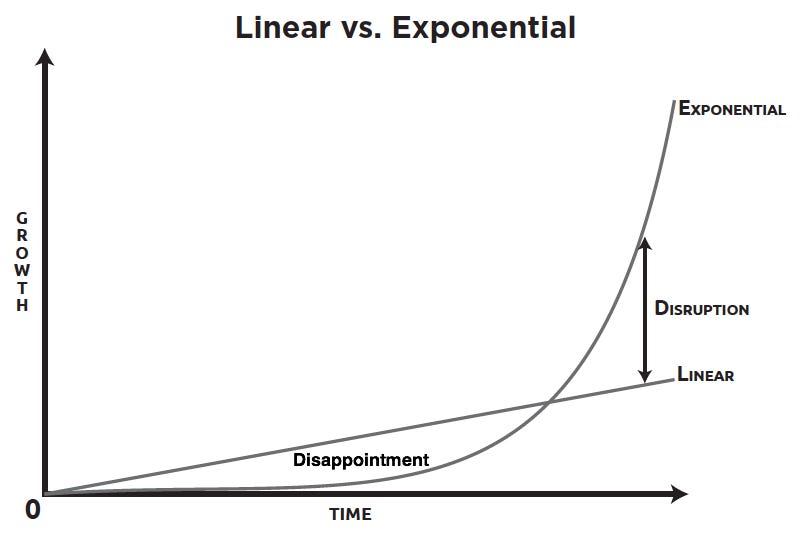

However, not all growth are the same. There is a need to differentiate between the types of growth because they are strong indicators of Output Y. More specifically, Linear and Exponential growth.

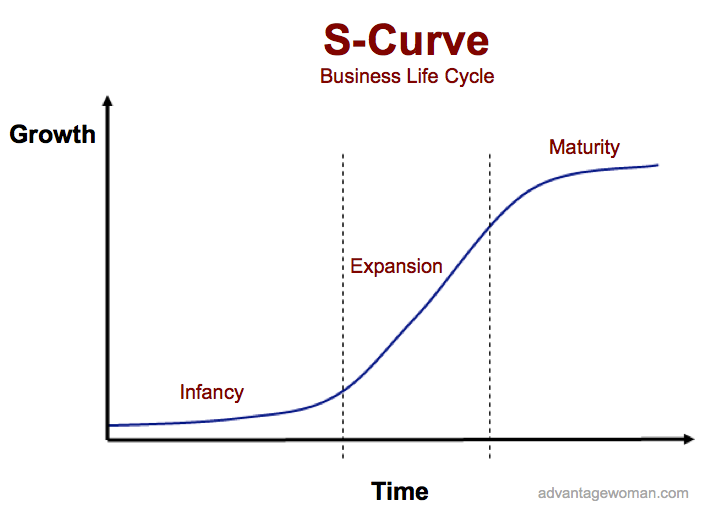

VC funds are looking for the startup with exponential growth. The graph above explains it plainly; exponential growth drives disruption while linear growth doesn’t. Yet there’s a stronger reason. Exponential growth curve suggests that the company is in the period of its life cycle that will see the greatest degree of change in a similar or shorter period of time. In the business cycle model, this is commonly known as the expansion phase.

Expansion phase is the best bet VC firms have to generate the necessary returns. Too early (Infancy) and earnings are peanuts but too late (Maturity) means missing the boat. So what do these mean to startups? Breaking it down, startups need to either show that they are at the start point of the exponential growth curve [Series A] or suggest that they are almost there and have the potential for an exponential growth curve [Seed Stage]. Obviously, it is a tougher sell at Seed Stage with more room for overt optimism, therefore investment amounts are smaller.

Other Factors

This represents the other components of the Due Diligence process. They are important-ish. My suggestion is to tailor the pitch and avoid information diarrhoea. If it is a 3 minutes pitch, cover 2–3 juicy points. Only go into details at 60 minute meetings. Even when that happens, remember to have a few key driving points, of which growth should be one of them.

Constraints: Time (Years)

Like a standard optimisation problem, there are constraints to Output Y [Returns]. Funds have the responsibility to return the principal and more to their Limited Partners by a certain time period. It works the same way as stocks and bonds. Funds typically last between 7–10 years. Translated to entrepreneur terms, companies should be hitting the highest point of the expansion curve in about 3 years (after Series A investment) — 5 years (after Seed-Stage Investment). Due to this constraint, rarely do VCs invest in opportunities that may take more than 10 years to achieve strong growth. Some examples (there are of course exceptions) include drugs for deadly illnesses (Cancer/Aids) and space colony technology (we have yet to build cheap rockets).

Obviously, there are a lot of things to consider when driving an investment deal in venture firms. Firms may differ in the variables that they use, but the goal is always the same. Optimise Y, a.k.a returns. When entrepreneurs understand this, two things are possible.

First, they emphasise exponential growth and get through VC deal flow pipelines further and faster. Second, they understand they are not building an exponential growth business and consider other avenues for funding.

So, might you just be what VC firms are looking for?

___________________________________________________________________

About the Author

This article was written by Jeremy Moi. Jeremy works at NewGen Capital, a micro-VC firm and analyses companies. The views he expressed above are solely his own though he thinks they resonate with many.