Bermuda joins Iceland and a select band of countries to approve electronic money institutions (Circle and Monerium respectively) which will be authorizedto issue electronic money anchored to the value of their currencies through stablecoins.

A growing number of countries are now moving toward digital currencies: China’s goal in issuing a cryptocurrency is to exercise further control over what its population gets up to, Switzerland is studying it, and numerous central banks around the world are reacting with concern to Facebook’s Libra, which is fast turning into a soap opera amid regulatory problems and the departure of several of its founding members. Facebook’s latest desperate maneuver could be to issue stablecoins based on national currencies such as the dollar and thus avoid regulatory scrutiny.

The Libra project has made it clear that electronic money is the future and that it is better for it to be regulated by governments, than a de facto privatizationrun for example by a company with such a terrible reputation as Facebook.Today In: Leadership

It is easy to explain Libra’s problems through a similar example, the failure of Facebook’s Portal, a video call screen equipped with artificial intelligence so the camera is focused at all times on the interlocutor, despite being, technically, one of the best devices of its kind, and also despite the desperate attempts of the company’s employees to evaluate it nicely on Amazon. Why doesn’t anybody want Portal? Because nobody likes the idea of a Facebook-owned device in their living room generating all kinds of data for the company to sell to advertisers. Does anyone, apart from Mark Zuckerberg, think that giving Facebook data about what we do with our money is a good idea?

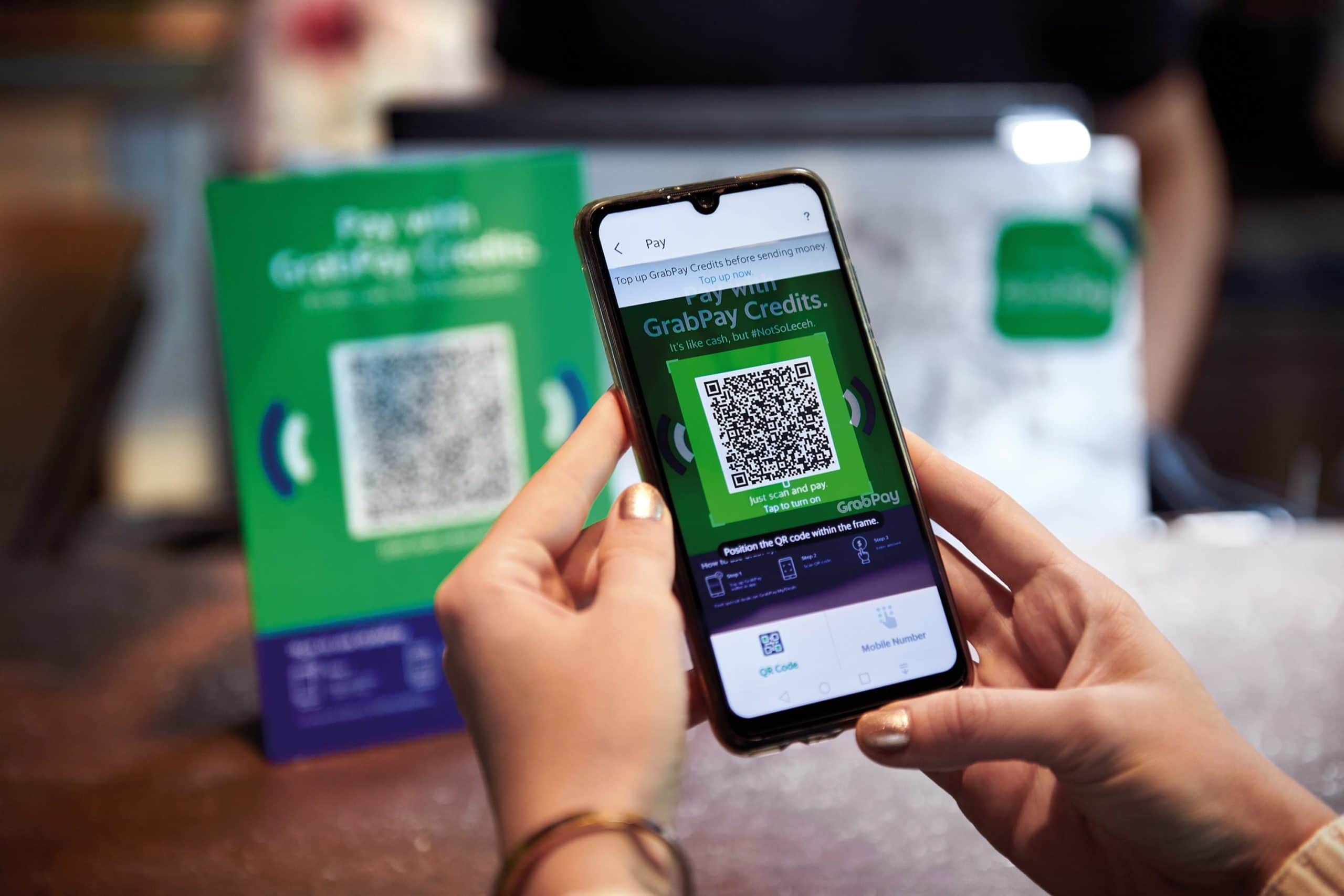

At the end of the day, people will only start using digital money if it is convenient to do so, or if governments tell them to, which is what will likely happen in China. Either way, we can expect to see a wave of electronic currency launches by a range of players, from private companies to central banks to consolidate and control a process already underway. Suddenly, something that was seen as happening way down the road, and dependent on all kinds of factors, is now a matter of life or death for financial authorities around the world if they wish to exercise any control over monetary policy. In a very short period of time, nation could lose control over the issuance of currencies to private companies able to launch fully transactional monetary instruments: a scary scenario.

PROMOTED

At this rate, within a few years, our idea of money, a central aspect of our societies, and how we use it, may have changed completely. This could happen in a more or less controlled way, it may be algorithmic and decentralized or strongly centralized, it may be based on blockchains or not, or it might be done through monetary policy. For the moment, everything is up in the air. Will we start out with stablecoins, which are relatively easy to understand, and then adopt some aspects of current cryptocurrencies as the system stabilizes? Will governments and central banks try to maintain their control over digital money as they do with conventional money? In short, what will the color of tomorrow’s money be?

About the Author

This article was written by Enrique Dans, professor of Innovation at IE Business School and blogger at enriquedans.com.