The rise of environmental, social and corporate governance investment (ESG) as a prioritization strategy is driving change in the financial landscape, obliging many companies to get on board.

Some observers see the reorientation of investment priorities toward sustainability as a $30 trillion market opportunity, while others insist that, regardless of the money involved, companies must integrate it into their strategies and operations, regarding it as a genuine form of value creation, instead of simply mentioning it in the annual report. Greenwashing may finally start to be seen as counterproductive.

The three strands of ESG investing are based on the following criteria:

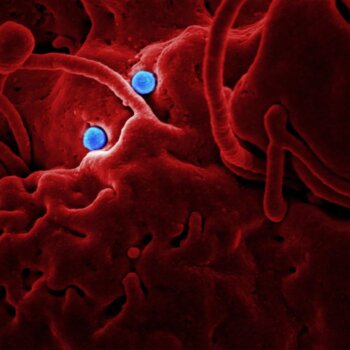

- Environmental: the impact a company has on the environment, from its carbon footprint, the potential toxic chemicals involved in its manufacturing processes, or the sustainability efforts it undertakes to control its supply chain.

- Social: the actions a company takes to improve its social impact, both within the company and the broader community, including factors ranging from LGBTQ, equality, racial diversity in senior management and staff in general, inclusion programs or hiring practices, to issues related to this sphere with respect to promoting social good universally, beyond the limited sphere of its industry.

- Governance: a company works to drive positive change, including everything from executive compensation issues to diversity in leadership to shareholder relations.

For The Economist, which recently created a data panel in the form of a portfolio of companies to analyze the phenomenon, this is not a bubble, but instead a trend that has already beyond the relatively narrow niches of sustainability, and which is increasingly self-sustaining: partly thanks to the priority given to ESG by a growing number of investors, but also due to best management practices: companies the market associates with the trend tend to be regarded as intrinsically better investments. In an environment where we have more and more information about the environment, the idea of making money while protecting the planet is an attractive one.

As such, the concept of ESG investing is about much more than simply mentioning environmental, social or governance issues in company communications: we are talking about studies of business practices conducted by independent third parties, objective scores and estimators with scales and weights awarded by recognized agencies, criteria for automated investment managers (robo-advisors) or levels of application, ranging from exclusion — BlackRock, the world’s largest investment fund, announced in January 2020 it would no longer include in its portfolio companies active in areas it considers negative for society, such as fossil fuels — to more active strategies such as corporate engagement: lobbying boards of directors to modify the strategy of their organizations, as happened recently in the case of several oil companies; or impact investing, investment specifically targeted at companies with a mission related to one of these issues.

One way or another, this is a phenomenon that, with concern for issues such as the climate emergency or the pandemic, is clearly more than a fad, and is becoming one of the major factors to be taken into account by large funds and companies that channel the investment of many, many people, and moreover, with very high growth.

It is particularly associated with young, educated investors, willing to put their money into the issues that really concern them, and far from the classic profile of investors only looking to make a profit regardless of ethical concerns.

Is your company aware of the importance of this phenomenon? Because if not, you could soon find yourself at a disadvantage with respect to other, more aware competitors, or with a part of the market denying you its money. In any event, for everyone’s sake, let’s hope that this will indeed start to become a problem for a more and more businesses, and sooner rather than later.