I recently had dinner with co-founders of a startup who’d just raised quite a bit of money for their company, a deal which incidentally I’d passed on. The meal was fantastic: fresh salmon from the bay, washed down with a particularly good New Zealand pinot noir, while watching the sun go down over the water. Really you’d expect my mood to have been chipper… but it wasn’t.

The evening was spent with the founders congratulating themselves for raising money. I’m not being a killjoy but it felt like the end of the line, not the beginning. It felt like all the preparation had been done, all the work completed, all the sweat, tears and marriage breakups had already been had, and now finally they’d succeeded. Except of course that wasn’t the case. This was the beginning not the end.

All they’d done was raise some money. Money which, though it may be needed to fulfill their goals, stands as a liability. Now, I’m all for celebrating success but this attitude really worries me and here’s why.

VC culture has come to equate raising capital with success, where each successive round of financing successfully completed is denoted as success,but you know what, VC culture is wrong.

Success is success and raising money is raising money. Let’s not confuse the two.

Raising money amounts to taking someone’s hard-earned capital. Capital which has been acquired by sweat, savings, maybe even theft but it’s someone else’s nevertheless. That, folks, is a liability no matter which way you spin it!

Realise that even if the capital never came with strings such as board seats, preferred equity, liquidation preferences or any host of other typical “strings”, realise that capital ALWAYS comes with strings which I’ll get to shortly.

So in the event that you’re an entrepreneur, emboldened by the fact that most anyone in Silicon Valley today sporting a hoodie, some pimples, and professing to work out of his grandmother’s garage, can get funded and at eye-watering valuations, let me give you 5 reasons why raising money may be a bad idea for your business:

1. Lack of Focus

Multi tasking is rarely a great strategy for any business. If you doubt me, try rubbing your belly and patting your head.

37signals built one of the most successful businesses in their niche by remaining extremely focused on just one product. My point is that it’s next to impossible to be running around raising capital, while remaining focused on building your fledgling business.

Unless you’re sitting in Silicon Valley which stands as a distinct anomaly to the rest of the world, let me assure that raising money will likely take you far longer than you ever thought, will come with more distractions than you’ve even thought, and the progress in your business will suffer.

2. ROI Can Be Poor

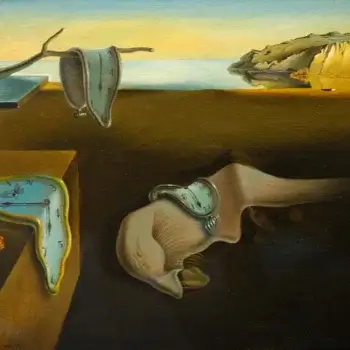

Time has a cost. The time spent raising money can often be time poorly spent.

I little while ago I was pitched by a company which had developed a minimum viable product, cheap to produce, easily shipped and which when sold, netted a $10,000 profit. The founders were, however, trying to raise $250,000 and had been on a road show for 3 months already!

Consider that by focusing on building, marketing and selling that very product they needed only 25 products sold to reach their $250,000 they had spent the last 3 months raising. The sheer insanity of what they were doing forever precluded any investment.

3. It Can Be Expensive

Further to the above, as an entrepreneur you might consider paying brokers to raise you capital. While this is an option realise that in any financing round up to Series A, it’s not uncommon to have to pay up to 15% of capital raised, and sometimes even include some warrants, preferred stock or options.

In short, it’s expensive money. Really expensive.

4. Capital Comes with Strings

You should expect that incoming investors may want board seats and input in your company. Do you want that? Does the capital you’re looking for come with the kind of strings you are comfortable with?

You can take money from all sorts of sources.

- Family and friends will invest because they like you, or maybe they hate you and want you to go away. Or they feel guilty and can’t bare the thought of the next thanksgiving dinner where they’re the only family member who haven’t backed your idea and aunt Marge will make a stink about it. These are psychological strings. Are you OK with them?

- Angels will invest if they believe you’ve got a good chance at success and often, if they feel they can, add some personal expertise. These guys are not stupid though, and will likely structure deal terms including ratchets, liquidation preferences and so forth. Strings may be that the input by the angel(s) is not something you want. These guys can be of immense value but make sure interests and personalities are aligned otherwise you risk a lot of strife.

- And venture capital comes with a set of different strings. This particular avenue of financing deserves an article in itself and I’ll write about it next week.

5. Too Much Capital Can Actually Be a Bad Thing

I’ve seen good ideas go to the wind when founders raise too much money. Money can certainly make people do daft things and I’ve learned that as well.

The fancy office space suddenly becomes “necessary”. Scrappy goes out the window in favour of “professional”.

You want to know what is really professional? A company that manages its cash flows, is scrappy as hell, is intensely, manically focused on building awesome value, and realises that when markets turn, as they always do, it’s the strong that survive and thrive. And the strong are always scrappy.

Make sure the money is aligned with your outcomes. Understand who you’re dealing with and what the motivations are. Most of all, don’t just follow the herd because the herd is rarely right.

If, after reading this, you’re not scared away and believe that your company has world changing potential, is less than $10M pre-money valuation and “needs to exist” then feel free to contact me. I’ll be happy to look at your pitch. I’ll almost certainly say no and be kind about it but maybe, just maybe that doesn’t take place.

____________________________________________

About the Author

This article was written by Chris of of capitalistexploits.at.