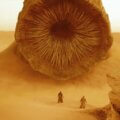

They say the economy has its seasons. Spring is when business is booming. In summer, growth slows, but revenues remain red hot. Autumn brings recession fears, but the occasional warm spell breeds complacence.

What about winter? Well – we’re in the depths of one right now. It’s an icy time when revenues plunge and credit freezes. Those who failed to anticipate hard times find themselves in a tight spot.

However, some winters are exceptionally cruel. They arrive far earlier than usual and feature temperatures far below average. In these downturns, even businesses that make reasonable preparations end up in trouble.

Let’s continue this analogy. Right now, the current COVID crisis resembles 1816 – The Year Without A Summer. The year before, Tambora – a volcano in Indonesia – blew its top, ejecting over 175 cubic kilometres or 6.2 trillion cubic feet of fine ash.

This dark cloud then shrouded the globe, reducing world temperatures by 0.7 degrees Celsius (1.2 degrees Fahrenheit) on average. Crops failed worldwide – that year, even the most prosperous societies experienced food riots.

COVID is the financial equivalent of this massive disaster. Through much of 2020, this novel pathogen has shut down most businesses, often for months at a time. With far less cash flowing in the economy, lending has slowed to a virtual standstill.

Facing ruin, SMEs are desperate for funding. Below, we’ll show how both governments and unsecured lenders have answered the call.

Governments Have Provided Emergency Support For Small Businesses

At the moment, the world is facing its gravest economic situation since the Great Depression. Back in April, one stat in particular brought home how dangerous things were. According to Marketwatch, 43% of American businesses said that without financial assistance, they would close within six months.

Similar headlines could be found elsewhere in the world. With many businesses (restaurants, small retail stores, etc.) shut completely, revenue went to zero within weeks. For those lucky enough to be open, revenues contracted sharply, as consumers conserved precious capital.

Amidst all this, banks were mostly sitting on their hands. As much hate as they usually get, you can’t blame them for doing this. After all, why would a profit-seeking entity throw capital into the empty black pit that COVID-19 had created?

In times like these, it’s the government’s responsibility to step in and act. Around the world, these acts have taken various forms. In Australia, the JobKeeper Payment paid businesses up to $1,500 per employee per fortnight. This initiative, along with Canada’s CERB, has helped keep liquidity flowing through their battered economies.

In America, PPP (Paycheck Protection Program) loans have given beleaguered businesses a much-needed life preserver. They have provided eligible companies with up to 10 million USD in emergency funding at 1% interest. As long as businesses use 60% of the balance on payroll, the loan becomes a grant.

Elsewhere, similar programs have also shored up payrolls. However, as the economy slowly reopens, these programs will eventually end. When they do, SMEs will still need ready access to funding. If legacy financial institutions are still locked down, where will entrepreneurs turn?

Unsecured Lenders Have Provided An Alternative To The Banks

Usually, it takes far less than a global pandemic for the banks to get cold feet. Sometimes, you need only shine a light on their misdeeds.

In 2018, the Australian government called an inquiry into financial industry wrongdoing. Called the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (or the Royal Commission for short), it forced Australia’s Big Four to revamp how they did business.

Long story short – they cut back on lending significantly. Almost overnight, SMEs were left high and dry. Prices of Australian real estate also fell, as fewer buyers qualified for mortgages. This situation only exacerbated the lack of access to business financing – with few banks accepting home equity as security, secured loans were off the table.

In their mad scramble for alternatives, Aussie entrepreneurs have turned to unsecured finance in droves. All of a sudden, firms like Prospa found themselves with scores of new customers. At the end of FY19, they recorded 136.4 million AUD in revenue, up 31.2% from FY18.

At a time when the Australian economy had been stalling due to decreased Chinese demand for their resources, these new funding sources made a huge difference. They shored up payroll as owners rushed to create new income streams. They also helped fund expansion plans that disappearing liquidity had put on hold.

And it appears that COVID hasn’t slowed private lenders down either. Halfway through the 2020 fiscal year, Prospa’s revenues were up 12% YoY. And, with the Australian government running measures like the Coronavirus SME Guarantee Scheme through Prospa and other non-bank unsecured lenders, their revenue has risen 13% YoY in the most recent quarter.

Online Lenders Take Risks That Banks Shy Away From

It’s heartening to see private lenders stepping up when legacy financial institutions have been hesitant to do so. However, banks make most of their money from loans. They’ve also been around much longer than non-bank lenders. To be precise, the modern institutions we’re familiar with have been around since the Renaissance.

Do private lenders know something the banks don’t? Or are non-bank institutions simply gambling by lending to higher-risk clients?

In most cases, these enterprises know exactly what they’re investing in. While it might not seem that way on the surface, they have better access to information than ever before. In the past half-decade, proprietary algorithms have given non-bank firms more ways to evaluate the creditworthiness of a borrower.

Rather than just running their FICO score, they can also analyze a client’s books. By taking monthly turnover, cash-on-hand, the age of a business, etc. and plugging into their formula, they can approve loans that banks won’t touch.

Nonetheless, these loans do give non-bank lending firms riskier portfolios. To make up for this, private lending firms charge higher interest rates than traditional financial institutions. For instance, SBA loans issued through an American bank have an average interest rate of around 6.2%. Rates for SBA-affiliated loans issued through private unsecured lenders are a bit higher, at about 7%.

For non-government backed private loans, average annual interest rates can be even higher. According to recent data, they can run from 9.99% to 26.5%.

Unsecured Lenders Have Done Much To Help SMEs

Financing at these percentages can be brutal. However, it has given startups and businesses with less-than-perfect credit a chance to get their operations off the ground.

Let’s travel in time back to 2008. Back then, the banks weren’t willing to give anyone a chance, as they were busy trying to wait out the Global Financial Crisis. However, firms like Kabbage, ondeck, and Prospa were. During those scary days, many enterprises were months away from going under. But, thanks to these private firms, a good number are still around today.

In the years since, unsecured lenders have helped even more businesses get started, stay afloat, and grow. Take the case of Jacie Dunkle, for instance. In 2016, the Charlottesville, Virginia restaurateur wanted to add an Irish pub to her holdings. And so, she started the Tin Whistle.

Soon after, though, surprise expenses began to catch up with her. When banks wouldn’t help her, she gave Kabbage a try. The same day, she got approved. Within 48 hours, the money was in her account. With a convenient repayment schedule and no regressive terms (like early payback penalties,) she made it through startup phase in fine shape.

Survival Is Job #1 Right Now

In these dire times, businesses that are usually viable are struggling to stay open. This current crisis is not a typical economic winter. Through continued government support and innovative private lending, though, resourceful entrepreneurs can get through this frigid season alive.

About the Author

This article has been submitted by one of our business authors.