Key Takeaway:

The tragedy of the Titan submersible has raised questions about why people would pay money for risk-taking experiences. Research shows that people with a net wealth of at least €1 million are typically extroverts and tolerant of risk, making them more drawn to thrill-seeking and risk-taking activities. However, personality is not set in stone and can change over a lifetime in response to experiences. Rich people may view risk-taking differently than those who view it as risk-averse. Authenticity is another aspect of risk-taking that is not regarded with much social value.

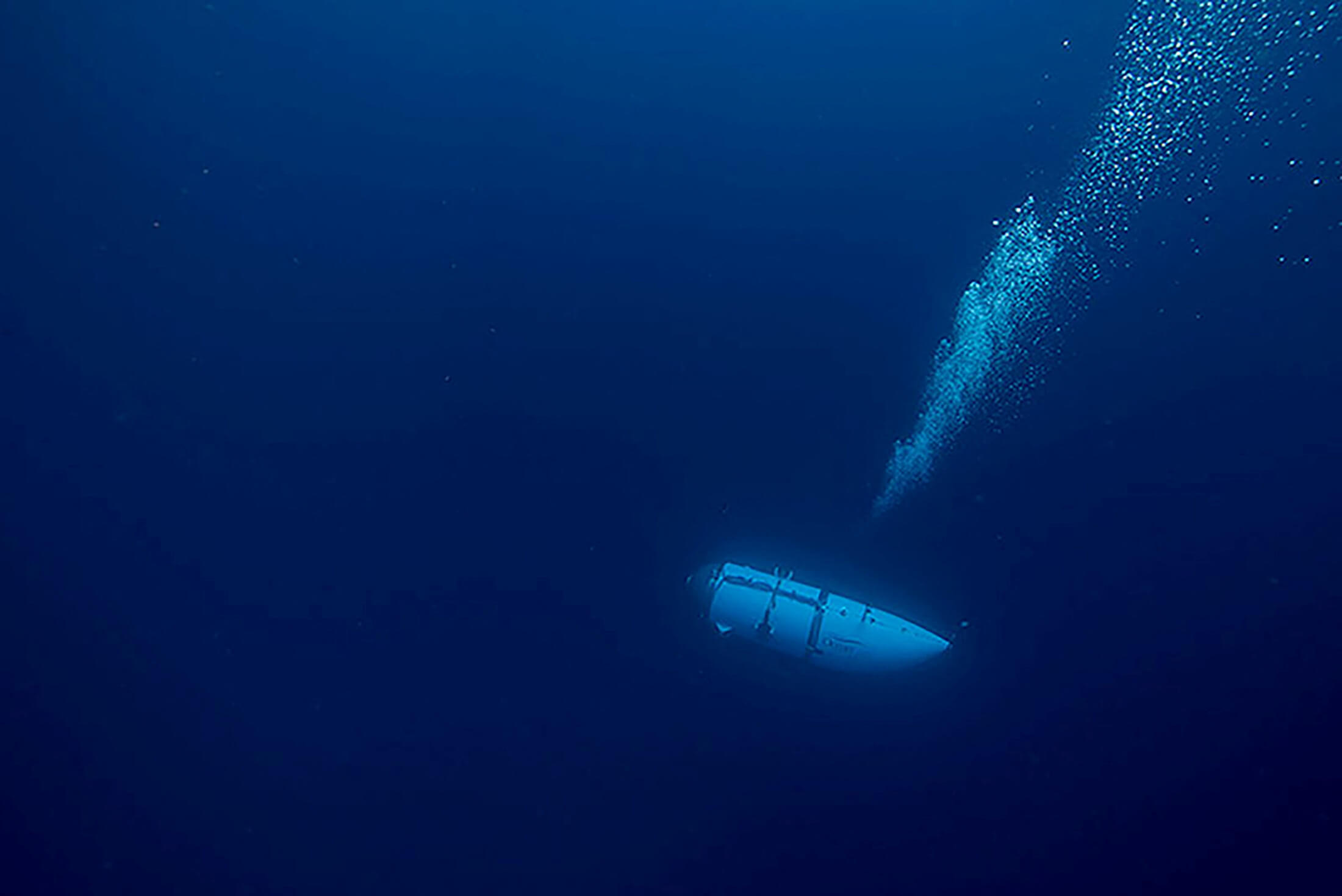

Like most people, I watched the tragedy of the Titan submersible unfold with horror. We talked about it in cafes, jumped when news reports came in on our phones, and wondered why people would ever actually pay money to experience such risk. Are billionaires like this ultimately just vain or stupid? Or is reckless risk-taking in their DNA?

It turns out there is a good deal of research on why rich people take risks that encompasses a number of areas of psychology. One paper, published in Nature, investigated how the personalities of 1,125 people in Germany with a net wealth of at least €1 million (so not everyone was “super rich”) differed from the rest of us.

The study nevertheless showed that people on these compratively higher incomes were typically extroverts and, importantly, tolerant of risk. That means they might indeed be more drawn to thrill seeking and risk-taking, in terms of adventuring and extreme sports.

As an expert, however, my next thought is one of those chicken and egg conundrums. What came first? The huge wealth or the specific personality make-up? Does the money shape the personality, or does the personality allow the person to develop such wealth?

The answer here is a little of both. A risk-taking personality can most likely help you make money. But, when you have acquired an enormous amount of wealth, you most likely also have a lot of security in your life – never having to worry about where your next meal will come from, or whether you’ll afford heating your house in winter. Some may experience this as life being a little too safe.

The French sociologist Pierre Bordieau argued that our way of being in the world – our “habitus” – is part of who we are. People in distinct cultures or with specific histories tend to share a habitus – meaning society can ultimately shape the mind of a person.

Take, for example, how much money we have. The rich do not think of sportscars as unobtainable – more as a suggestion of what might look nice on their driveway. Their wealth in part shapes their view of the world and how they live in it. If taking risks is a part of the personality of the rich, it will be a relatively normal experience in their everyday engagement with the world.

But research has also shown that personality isn’t set in stone – it changes over a lifetime in response to experiences. For example, a new life experience, such as moving away to university or having a child, may alter your world view in such a way that your personality and the way you interact with the world change.

If you take a lot of risks in your everyday life, this becomes a reflection of what makes you who you are – boosting your risk-taking personality trait, which leads to more risk-taking experiences, and so on. This may explain why many rich people end up becoming risk-takers, whether it is in their genes or not.

Authenticity

Rich people may view risk-taking rather differently to those of us, like me, who regard ourselves as risk averse.

Dangerous activities for me are far from my own personality. So, when I do find myself engaging in something potentially risky, outside my normal habitus experience, I feel very uncomfortable. For the risk averse, “living life to the full” does not require base-jumping or free-climbing – these things are inconsistent with their experience.

By this logic, it makes sense that the rich engage in risky experiences. Driving fast cars, skiing and skydiving are normal expressions of this sort of risk acceptance for a lot of people. But if you’re very rich, even more extreme examples of very dangerous experiences open up, which may ultimately help them live an authentic life – being true to who they are.

Interestingly, a risk-averse form of living life authentically is not regarded with a great deal of social value. We often assume that a full life should obviously involve white-water rafting, horse riding and, if you can afford it, space flight.

Those who take risks are also often seen as desirable in business– as people who can move a company on. Again, risk-aversion is seen as less desirable here. Rather than viewing it as a reflection of solidity and stability, providing a calm and steadying influence, we often see it as holding things back.

I would argue that both ways of engaging with the world are perfectly valid and should be similarly valued. After all, our species has relied on a mix of the two to flourish: both explorers and risk assessors.

Eudaimonia

Capitalism is all about consumption – and it rules most of the world. From heavily branded handbags and sleek sportscars to expensive activities, it’s what we do and what many of us value. We even consume to fulfil our existential desires.

What might those be? “Eudaimonia” is about living life to the full in a satisfying way. Aristotle described it as the very highest of human virtues – a positive and divine state of being. Epicurus, his contemporary, argued that pleasurable living is the most authentic way to describe eudaimonia.

As such, I would argue that rich, risk-taking people are simply consuming in a way that satisfies them as much as possible in terms of eudaimonia. The risk-averse ultimately do the same thing, but in a very different way. Both are living authentically, pleasurably and naturally, with reference to their habitus.

It’s not weird that people would pay handsomely for the experience promised by Titan. Before we dismiss it on the grounds of greedy stupidity, we might want to consider the more respectable reasons behind such behaviour.

And if we want fewer accidents, we may want to consider how we as a society value risk-taking, and undervalue safety regulations, rather than blaming it on individuals who are just trying to live a fulfilling life – be they billionaires or otherwise.