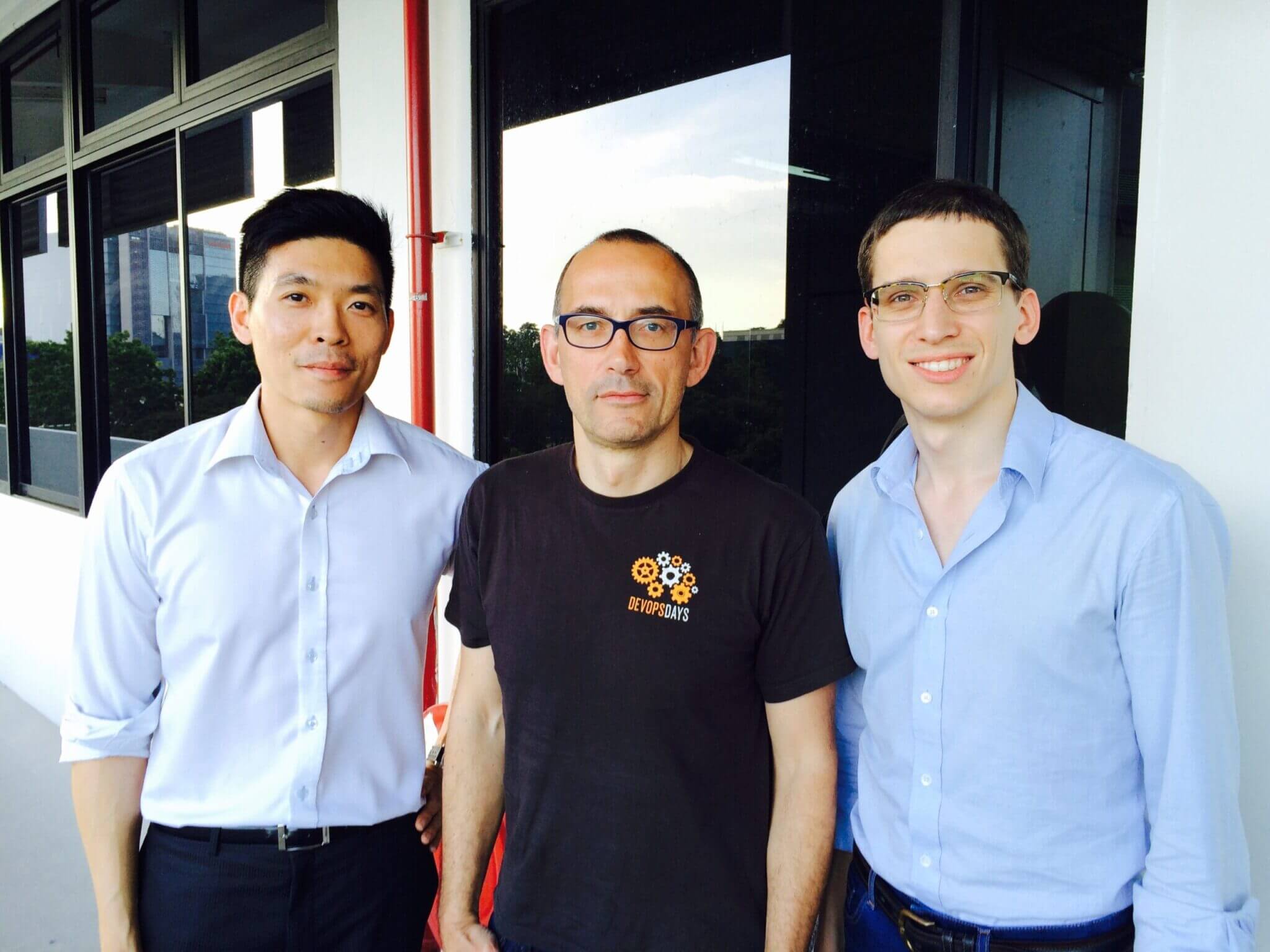

Pawel Kuznicki(right) was born in Poland pursued his studies at the University of St Andrews, UK from which he graduated with MA Hons Economics and Philosophy First Class. After graduation he worked at McKinsey & Company in Europe and Africa. Then, Pawel moved to Singapore to join Rocket Internet, building Zalora and Lazada in the region. In 2014, Pawel got married with a Singaporean and started Capital Match as its Co-Founder & CEO.

In your own words what is Capital Match?

Capital Match is a peer-to-peer lending platform focused on SMEs. We provide affordable working capital to SMEs from professional investors

How did you come up with the idea of Capital Match?

I followed the peer-to-peer lending market in the US and UK for a few years, noticed an unmet need in Singapore (and no local players) and decided to start this business. The business model was already tested elsewhere, the key challenge was to start it in Singapore.

Could you walk us through the process of starting up Capital Match?

It was a small-steps process:

1. Setting up a website to attract attention of potential customers

2. Clarifying legal and regulatory framework

3. Confirming co-founders and other team members

4. Securing initial funding

5. Finalizing legal documentation and getting the initial product up and running

6. Securing first deal…

Did you encounter any particular difficulties during startup?

I wouldn’t say there were any big difficulties. Rather the process was slower than expected, largely due to the fact that it’s a brand new industry in Singapore – there is no awareness of the market so it requires a lot of education to build trust and acquire customers. It’s more of solving everyday small challenges and push the business forward.

What’s the developmental direction?

The three pillars of the business development have been: (1) Great technology as soon as possible, (2) No compromise on risk assessment and management, and (3) Fast growth (to attract more investment). So far so good. We are still focusing on the same three pillars with varying focus at different times. Though I do not expect significant shift regarding this strategic direction for the foreseeable future.

What kind of feedback did you get for Capital Match so far?

We do serve a currently unmet need in the market – providing a great value proposition to both lenders and borrowers. Our customers are happy of what they are getting and praise our customer service. The key constructive feedback that we get, which we are grateful for, is for us to improve the efficiency of the process – from user interface to the process of signing documents to additional features enabling easier funding process on the platform. We are aware of those deficiencies and will be implementing the relevant improvements shortly.

What is your strategy against your competition?

There is currently only one competitor – in terms of business model – in Singapore. We do believe we have certain competitive advantages over them, but the lending market is so large that we don’t think we would really compete for clients in the next 2-3 years.

Have you developed any industry insights that you could share?

The industry is definitely under-served. Banks are not interested in those customers and few other players provide capital to SMEs in this market. At the same time, investors are hungry for yield. We create a channel for both parties to exchange capital for fixed-income return. Win-win situation.

How do you plan to stay relevant in this industry?

Our key focus in on building proprietary technology and ensuring liquidity on both sides (lenders and borrowers). On technology front, we have a world-class team of developers with two key people with 20 years development experience each. On liquidity front, we are working to secure key relationships and partnerships in the market as well as continue offering a great value proposition to lenders.

What is the future of the industry in your opinion?

It is exciting! If you look at the example of the US or UK, peer-to-peer are growing rapidly slowing taking away banks’ business. The potential market is huge – we’re talking about tens of billions of dollars in outstanding loans in Singapore alone that no one serves right now (banks provide few loans in the segment). It will take time to build awareness and adoption, but the potential is huge.

Were there anything that disappointed you initially?

Not really… maybe slow pace of customer acquisition. But I guess I should have expected that. Otherwise no major disappointments.

What do you think about being an entrepreneur in Asia?

Being entrepreneur in Singapore is slightly easier than in the West – because of lower competition. People are more risk-averse in Asia (with maybe an exception of China) and tend to choose corporate careers rather than entrepreneurial “struggle”. In the West people are more adventurous in this sense. So it is slightly easier in Asia because statistically there will be fewer competitors in your business – especially if you’re trying to build and an innovative or technology business.

What is your opinion on Asian entrepreneurship vs Western entrepreneurship?

There are differences in corporate cultures between Asia and the West, but I have not really noticed major differences between entrepreneurs. I think it’s a more universal concept. The only difference that strikes me a bit is an organizational hierarchy – it’s a corporate characteristic anyway but can also be observed among entrepreneurs. There is much more defined hierarchy in Asia than it is in the West. The culture is more “participative” in the West; in Asia it’s more top-down. But beside that it’s very similar.

What is your definition of success?

Providing service that customers desire, steadily growing sales month-over-month, building better and better team and the product, and creating a sustainable, profitable business over long term. And having a little bit of fun in the meantime.

Why did you decide to become an entrepreneur?

I need to be in control of how things work. If have independence and control of the situation, then I will make things happen. It’s a boost, a motivation like no other. I had corporate jobs before, but no other professional experience had ever given me so much satisfaction like my entrepreneurial experience.

What do you think are the most important things entrepreneurs should keep in mind?

Never to give up. Often it’s tough, sometimes it’s really tough. But you need to keep going, otherwise you might miss a chance that might be just around the corner.

In your opinion, what are the keys to entrepreneurial success?

Resourcefulness, hard work and ability to build meaningful relationships – with customers, suppliers, team members, investors.

Any parting words of wisdom for entrepreneurs out there?

Just never give up and push hard – you will get there one day.

Connect

Website: www.capital-match.com

LinkedIn: www.linkedin.com/in/pawelkuznicki