Airbnb just went public in a debut that’s been widely celebrated. We dug into the company’s prospectus and learned some interesting facts about their business and travel trends.

Cash flow is highly seasonal. ABNB makes all it’s money in Q3. As you can see, that’s pretty much the only quarter in which the company is comfortably EBITDA positive in any given year. This is due to the fact that the bulk of ABNB’s customers travel in Q3, hence revenue is earned at that point.

Airbnb generated EBITDA. During 2017 and 2018, the company did generate material positive EBITDA. In 2019, they swung back to a loss due to rising costs across the board, and it looks highly likely they’ll burn again in 2020.

Airbnb generates significant free cash flow. Thanks to unearned fees, which is the payment customers make when they book a reservation, Airbnb does generate free cash flow even in years where they are unprofitable. Cash flow is especially strong in Q1 and Q2 when customers book their stays, and then declines in Q3 when many of the stays actually occur (see seasonality above) and Airbnb has to pay those reservations out to the host. Airbnb keeps 15% of every booking.

Strong founder ownership. The three founders (Brian, Nathan, Joseph) own 14.1% to 15.3% each. This is an extraordinary level of ownership for a 3-founder company going public. This is due to two things: strong free cash flow generation and more importantly the ability for Airbnb to raise capital at consistently high valuations.

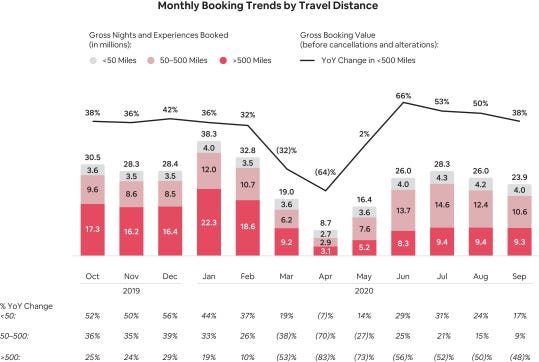

Covid hurt a lot. Bookings in Q2 fell to $3.2bln whereas in Q2 2019, bookings were $9.8bln. That’s a 67% decline. The rebound in Q3 of 2020 however was dramatic as demand for travel exploded.

Short trips are in. Thanks in part to covid, people are taking shorter trips. “Short-distance travel within 50 miles of guest origin has been highly resilient, even at the peak of the business interruption in April. Short-distance stays were one of the fastest growing categories prior to the COVID-19 pandemic. This growth was further bolstered by the COVID-19 pandemic, as many guests chose short-distance trips instead of long-distance travel.”

Airbnb’s prospectus provides a very interesting look into travel trends and the economics of running a marketplace.

About the Author

This article was written by Sammy Abdullah, co-founder at Blossom Street Ventures. Email him at [email protected]

“Visit us at blossomstreetventures.com and email us directly with Series A or B opportunities at [email protected]. Connect on LI as well. We invest $1mm to $1.5mm in growth rounds, inside rounds, small rounds, cap table restructurings, note clean outs, and other ‘special situations’ all over the US & Canada.“